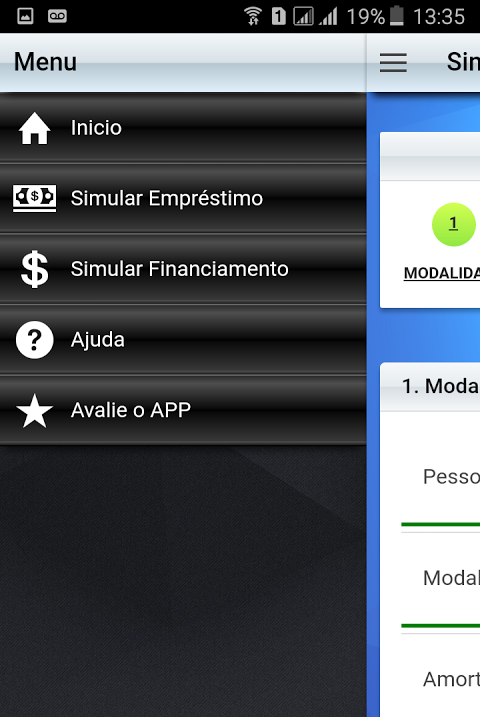

Simulador Empréstimo Bancário is a helpful app for anyone in Brazil who is looking to negotiate a new credit, portability, or financing contract. With this app, you can easily set up your credit operation based on the rates offered by the country's leading financial institutions. The main features of CredSimulator include demonstrating the average rates used by Brazilian banks, calculating loan, property, and vehicle financing installments, calculating the IOF taxes with updated rates, and calculating the CET rate which is the total effective cost. Download the app now!

Features of Simulador Empréstimo Bancário:

❤ Accurate and Comprehensive: It provides a comprehensive overview of the rates and costs associated with credit operations in Brazil. It uses the average rates practiced by major financial institutions in the country, ensuring that users have access to accurate and up-to-date information.

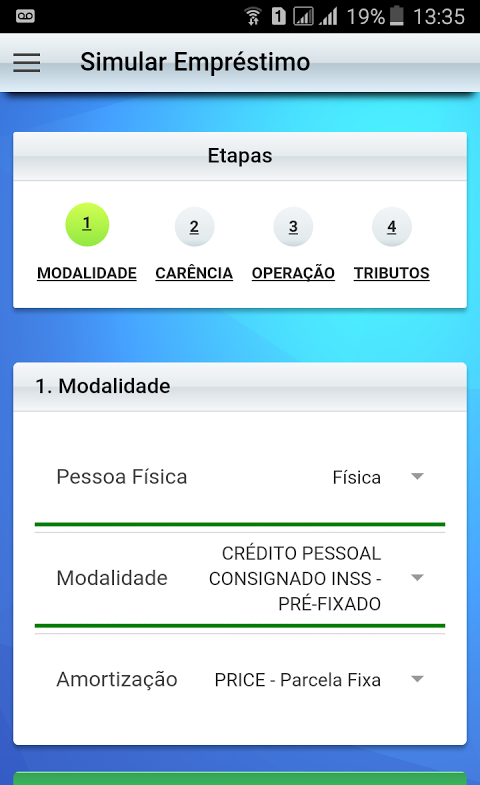

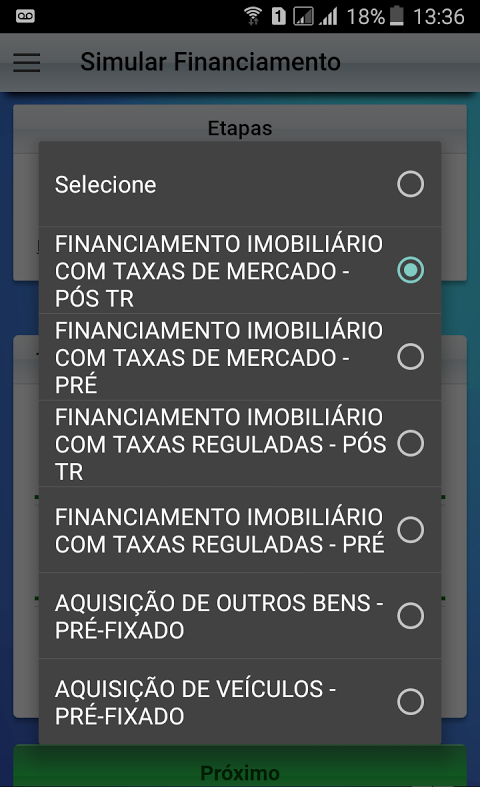

❤ Multiple Types of Loans: This app caters to various types of loans including personal loans, property financing, and vehicle financing. Whether you are looking for a new credit contract, portability, or financing, it can help you make informed decisions.

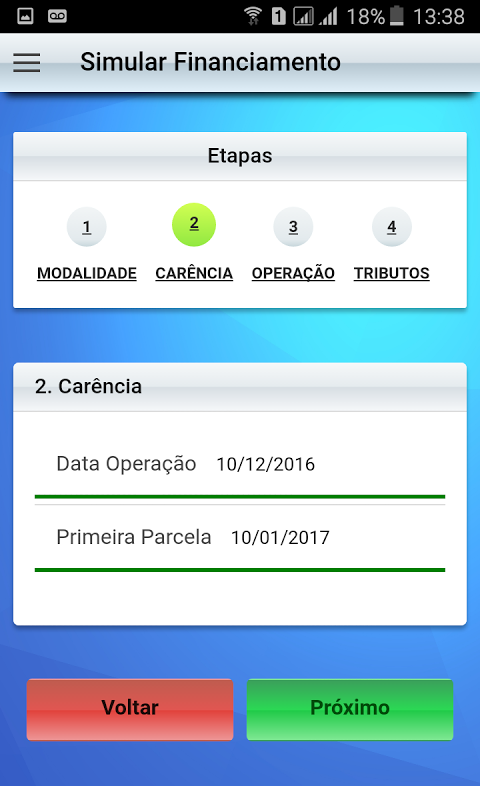

❤ Convenient Installment Calculation: With the app's installment calculation feature, users can easily determine the monthly payments for their desired loan amount and term. It offers different calculation methods such as PRICE, SAC, and SAM, providing flexibility and convenience.

❤ Clear Understanding of Costs: It goes beyond just interest rates and helps users understand the total cost of a credit operation. It calculates the Total Effective Cost (CET rate), which includes all costs involved such as interest, taxes, and fees. This transparency allows users to make well-informed decisions while considering the complete financial implications.

Tips for Users:

❤ Explore Different Loan Types: Take advantage of the app's versatility by exploring the calculations for different types of loans. Whether you are planning to buy a property or need a personal loan, the Simulador Empréstimo Bancário can provide you with the necessary information and help you compare different options.

❤ Use Different Calculation Methods: Experiment with different calculation methods available in the app, such as PRICE, SAC, and SAM. This can give you a better understanding of how different loan structures affect your monthly payments and overall costs.

❤ Share Simulation Results: Utilize the app's sharing feature to easily share your simulation results with others. This can be useful when discussing loan options with a partner, family member, or financial advisor. Sharing the simulation allows for collaboration and informed decision-making.

Conclusion:

Simulador Empréstimo Bancário empowers users to make informed decisions when it comes to credit operations in Brazil. By providing accurate and up-to-date information on average rates, comprehensive cost calculations, and versatile loan types, the app ensures transparency and helps users negotiate the best credit or financing contracts. Its convenient installment calculation feature and sharing options make it a user-friendly and collaborative tool. Whether you are a borrower, financial advisor, or simply seeking to understand the financial implications of different credit operations, Simulador Empréstimo Bancário is an invaluable resource.