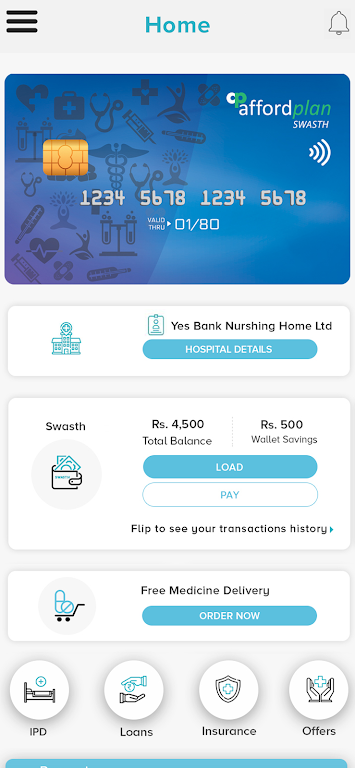

Introducing Affordplan Swasth, the ultimate solution for your healthcare financial needs. With this innovative healthcare savings card, you can access exclusive offers at your preferred hospital, allowing you to save on every medical bill. But that's not all - it also offers a range of value-added services. Enjoy cashback on each spend at the hospital, including bonus cash to jumpstart your first transaction. You'll also have access to health insurance, home delivery of medicines, and even medical loans at low or no interest rates for surgical procedures.

Features of Affordplan Swasth:

- Savings on medical bills: It offers cashback on every spend at the hospital, giving you an opportunity to save money on your medical bills. This can be a significant advantage, especially for those who frequently require medical treatments or have chronic illnesses.

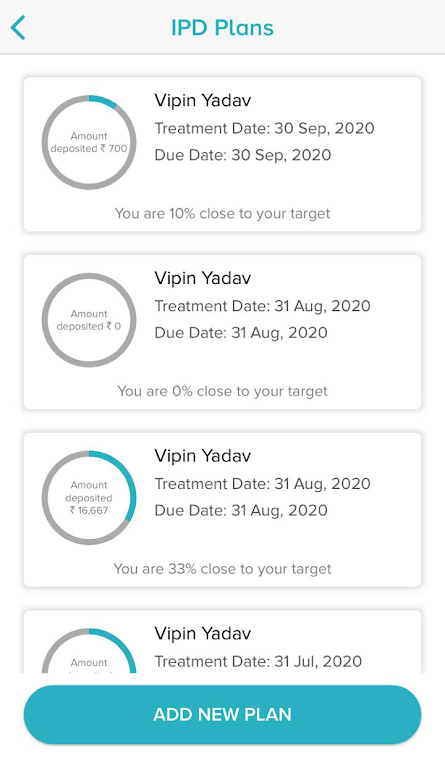

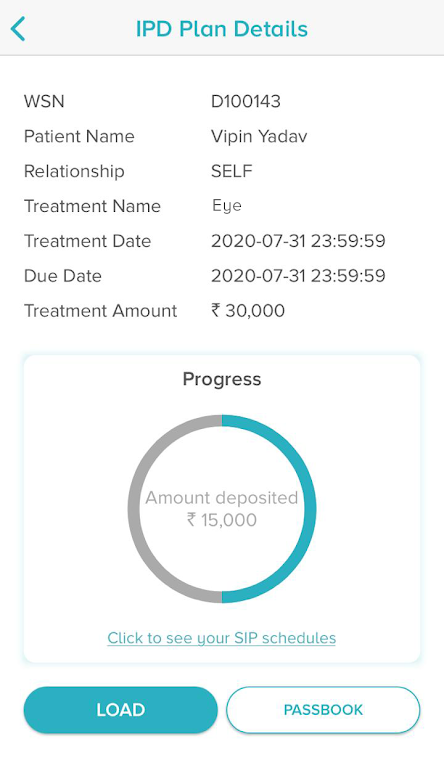

- Value-added services: The healthcare savings card provides a range of value-added services that can enhance your healthcare experience. These services include home delivery of medicines, access to health insurance, and medical loans for surgical procedures at low or no rates of interest. Such services can make healthcare more convenient and affordable.

- Exclusive rewards: It offers exclusive rewards on favorite brands through its partner tie-ups. This not only provides additional savings but also gives you an opportunity to enjoy perks from your preferred brands. These rewards can further enhance your healthcare journey and make it more enjoyable.

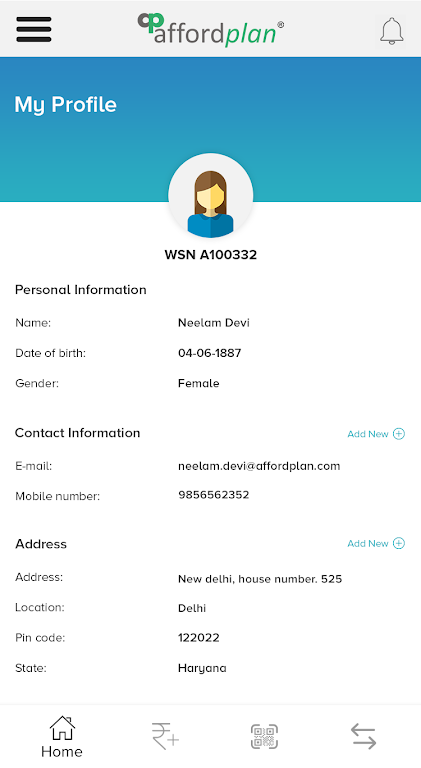

- Dedicated Financial Counselor: With Affordplan Swasth, you will have the support of a dedicated financial counselor. This professional can guide you through your healthcare financial needs, helping you understand the best ways to manage your expenses and maximize the benefits and savings offered by the card.

FAQs:

- How does the cashback on medical bills work?

- When you use it at partner hospitals, a certain percentage of your medical bill amount will be credited back to your savings card as cashback. This cashback can then be used for future medical expenses.

- Can I use the card for any hospital or healthcare provider?

- It is accepted at a wide network of partner hospitals and healthcare providers. You can check the list of partners on the app or website to ensure your preferred healthcare provider is included.

- How do I apply for a medical loan through it?

- The app or website will have a simple application process for medical loans. You can provide the necessary information and documentation, and the dedicated financial counselor will guide you through the loan process.

Conclusion:

Affordplan Swasth is a comprehensive healthcare savings card that offers attractive benefits and savings for your healthcare needs. With cashback on medical bills, value-added services like home delivery of medicines and health insurance, exclusive rewards, and the support of a dedicated financial counselor, the card helps you save money and make healthcare more convenient and affordable. Whether you require frequent medical treatments or are planning for a surgical procedure, Affordplan Swasth can be a valuable tool to manage your healthcare expenses. Take advantage of this innovative solution to save on medical bills and enjoy a better healthcare experience.