Money Dashboard Budget Planner is a secure app that helps you keep track of your spending and income across all your bank accounts in one place. By using this app, you can start saving money every day, cut down on household bills, and make smarter financial decisions. Whether you're paying off loans or just want to focus on building up savings, Money Dashboard's award-winning budget planner takes the hassle out of managing your money. With Money Dashboard, you can take control of your finances and live a happier financial life.

Features of Money Dashboard Budget Planner:

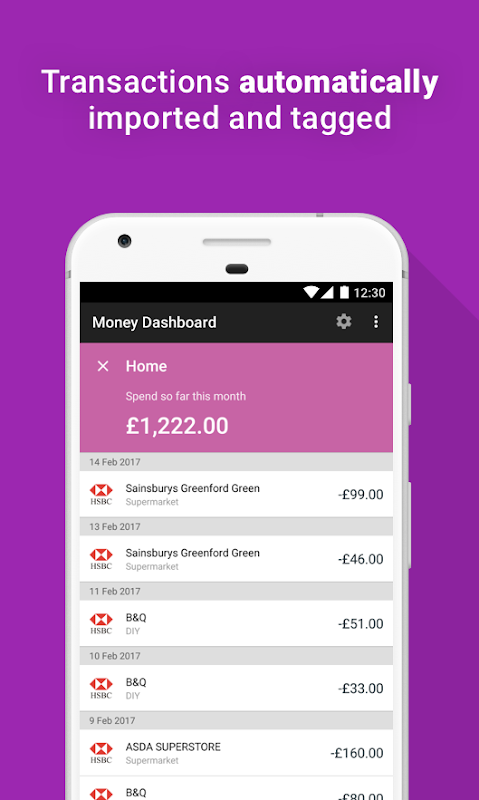

* Track all spending and income: It allows you to easily track all your spending and income across your current, credit card, and savings accounts, regardless of which bank you use. This feature gives you a comprehensive view of your finances in one secure app.

* Make informed financial decisions: By understanding where your money goes each month, you can make more informed financial decisions. Money Dashboard helps you identify areas where you can save money, cut household bills, and make better choices with your finances.

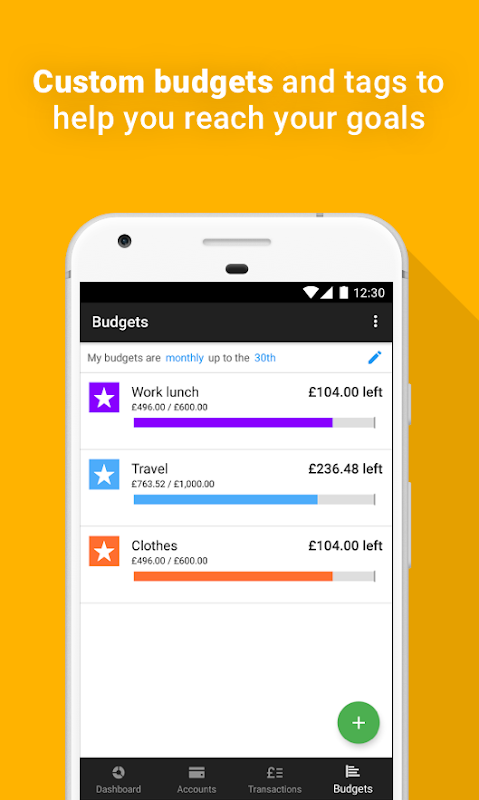

* Simplify budgeting: Managing your money and creating a budget doesn't have to be a hassle. Money Dashboard's award-winning budget planner automatically categorizes your spending, from groceries to leisure and household bills, making it easy to stay on track and avoid falling into debt.

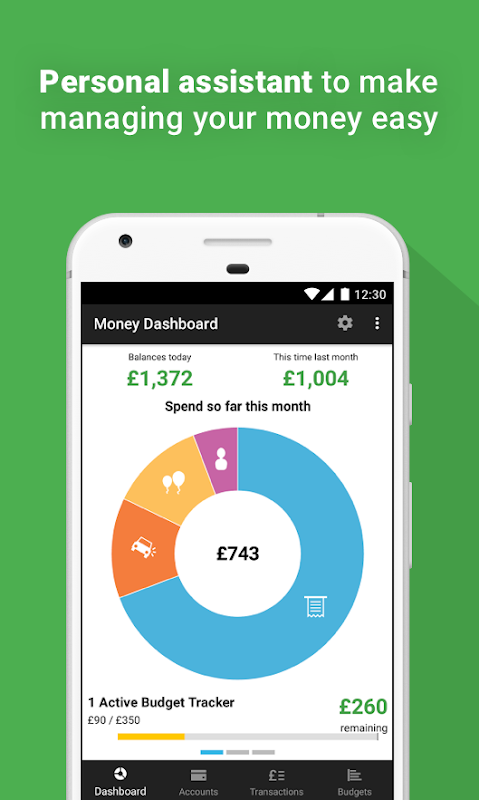

* Clear and helpful charts: It provides clear and helpful charts that display all your financial information at a glance. Whether you want to see a breakdown of your spending or analyze your balances, these charts make it easy to understand your financial situation.

Tips for Users:

* Connect all your accounts: To fully benefit from Money Dashboard, make sure to connect all your current accounts, savings accounts, and credit cards. This will allow you to view and manage all your financial information in one place.

* Set up informed budgets: Take advantage of Money Dashboard's budget planner to create informed budgets based on your spending from the previous month. This will help you ensure that you're allocating your salary towards the things you want, while still saving and managing your finances effectively.

* Use the cashflow planner: Access the Money Dashboard website for additional functionality, such as the cashflow planner. This tool can help you avoid using your overdraft unnecessarily and plan your way out of debt, providing even more control and insight into your financial health.

Conclusion:

Money Dashboard Budget Planner offers a range of attractive features that make it easy to track your finances, make informed decisions, and simplify budgeting. With the ability to connect all your accounts and view transactions and balances in one secure portal, you have everything you need to take control of your financial health. The clear charts and budget planner help you understand your spending and set budgets, while the cashflow planner helps you plan for the future. Don't just take our word for it; leading publications recognize Money Dashboard as a valuable tool for managing household finances. Start using Money Dashboard today and take control of your financial future.