Fintonic - Finanzas Personales is not your average financial app, it's the ultimate tool to maximize your money. With almost half a million users and five years of experience, Fintonic provides a centralized platform for all your financial needs. From accounts to insurance, Fintonic organizes and simplifies your finances with ease. But that's not all - Fintonic goes beyond traditional banking apps by offering unique alerts and insights that your bank won't provide. Say goodbye to hidden fees, duplicate charges, and insurance payment surprises.

Features of Fintonic - Finanzas Personales:

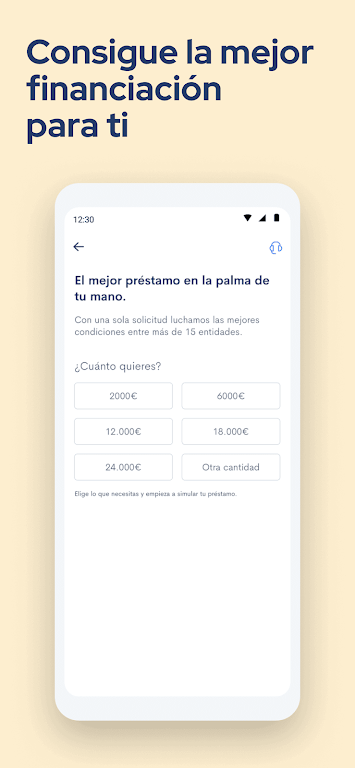

> All-in-one Financial Management: It offers a convenient solution to manage all your financial products in one place. From accounts to insurance, cards to loans, mortgages to investment products, Fintonic has you covered. This saves you time and hassle, allowing you to stay on top of your finances effortlessly.

> Smart Alerts: Fintonic goes beyond what your bank app offers by providing you with exclusive alerts. You'll receive notifications about commissions, duplicate receipts, and even when your car insurance is about to expire. With Fintonic, you'll never miss an important financial update or fall victim to unexpected charges.

> Savings and Organization: It helps you save and organize your money effectively. It displays the status of your accounts in a simple and easy-to-understand manner. By using the Finscore tool, you can track your saving and spending habits, empowering you to make better financial decisions and potentially secure better conditions among multiple entities.

> Savings Potential: Fintonic has an impressive track record of saving its users money. In 2017 alone, Fintonic saved its users a staggering 13 million euros in returned commissions. Additionally, it sent out 260,000 notices for duplicate charges and provided 278.379 overdraft alerts. With Fintonic, you can expect significant savings and financial protection.

Tips for Users:

> Take advantage of the alerts: Make sure to enable notifications from Fintonic. These alerts will keep you informed about any potential issues with your finances, such as duplicate charges or expiring insurance. By acting promptly, you can avoid unnecessary expenses and save money.

> Regularly check your Finscore: Fintonic's Finscore tool provides valuable insights into your financial standing. Keep an eye on this score and use it as a guide to improve your financial situation. Take advantage of Fintonic's tips and suggestions to optimize your saving and spending habits.

> Explore product recommendations: Fintonic works with over 50 entities, offering you a wide range of financial products. Take the time to explore the recommendations provided by Fintonic. You might find better conditions or options that suit your needs more effectively.

Conclusion:

Fintonic - Finanzas Personales serves as a must-have app for anyone looking to maximize their financial management. With its all-in-one approach, smart alerts, and emphasis on savings and organization, Fintonic simplifies the way you handle your money. By connecting your bank accounts, you gain access to a comprehensive overview of your financial products, ensuring nothing slips through the cracks. Fintonic's success in saving users money and protecting them from unnecessary charges speaks for itself. Don't miss out on the opportunity to take control of your finances with Fintonic. Get started today and experience the benefits for yourself.