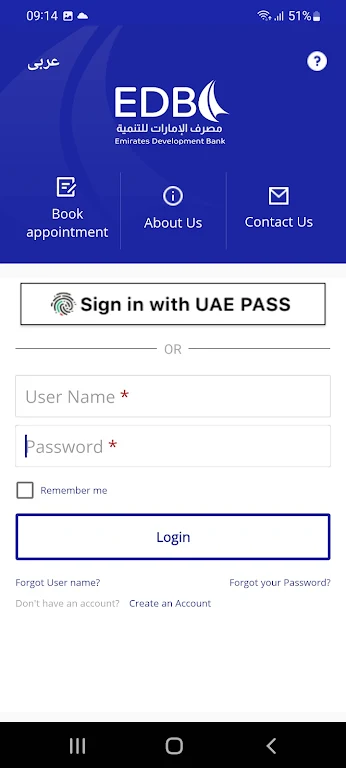

The EDB Home Finance app is your key to turning your dream of homeownership into a reality. Designed specifically for United Arab Emirates citizens and families, this app from Emirates Development Bank offers an array of services that align with the country's Vision 2021. From easy home finance applications to hassle-free maintenance options like rescheduling payments or adjusting loan principals, this app has it all. You can even download liability certificates and loan statements with just a few taps. With EDB Home Finance, achieving social cohesion, family security, and luxurious living has never been easier.

Features of EDB Home Finance:

> Home Finance Applications: The EDB Home Finance app provides a seamless and convenient way for United Arab Emirates citizens and families to apply for home finance. With just a few taps, users can submit all the necessary documents and information required for their loan application. The app streamlines the application process, saving users time and effort.

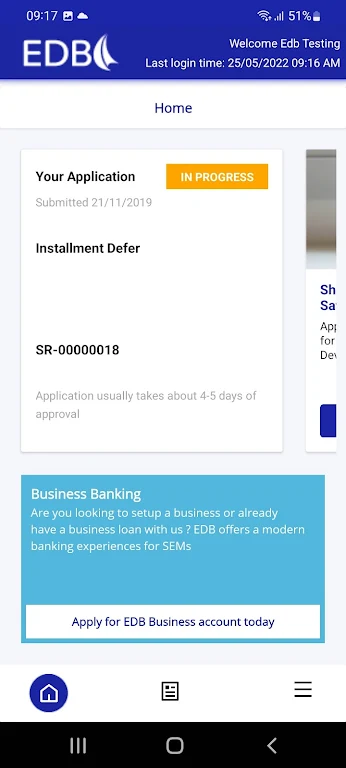

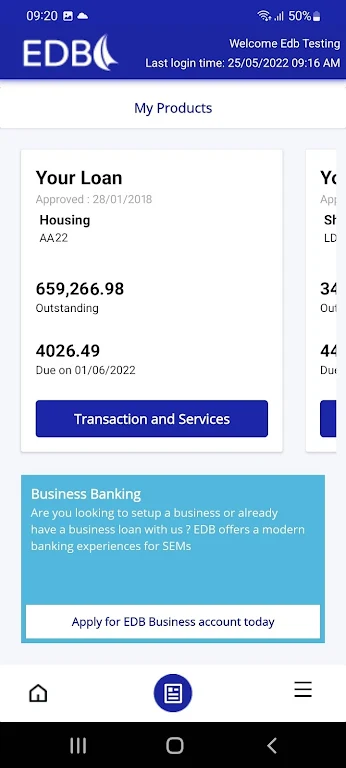

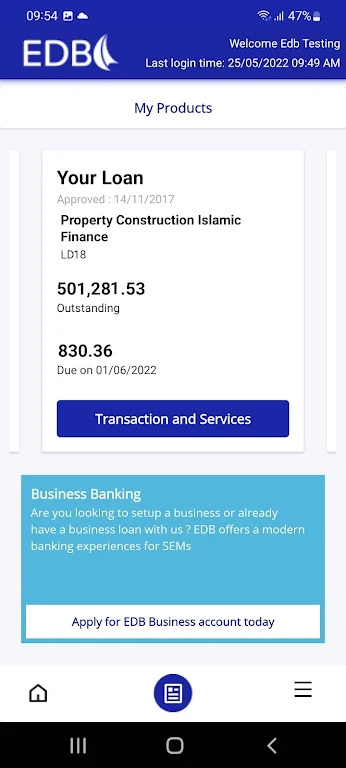

> Finance Maintenance: The app offers various finance maintenance features to help users manage their home loans effectively. Users can easily reschedule their loan payments, increase or decrease their loan principal, and even defer their installments if needed. These features allow users to adapt their loan terms to their changing financial circumstances, ensuring flexibility and convenience.

> Liability Certificates: The app allows users to generate liability certificates, which are essential documents for various purposes like visa applications and legal requirements. Users can retrieve these certificates anytime, anywhere, without the need to visit a physical branch. This reduces bureaucratic processes and saves users valuable time.

> Loan Statement Direct Debit Schedule Downloads: Users can access and download their loan statements and direct debit schedules directly from the app. This provides them with a transparent view of their loans, payments, and outstanding amounts. It also enables users to keep track of their finances and plan their budgets efficiently.

Tips for Users:

> Keep your documents ready: Before starting the home finance application process, make sure you have all the necessary documents readily available, such as proof of income, identification, and property details. This will help you complete the application smoothly and quickly.

> Utilize finance maintenance features: Take advantage of the finance maintenance features offered by the app. If you need to change your loan terms or defer payments, use these features to manage your finances effectively and avoid any unnecessary penalties.

> Regularly check loan statements: Make it a habit to regularly check your loan statements and direct debit schedules available on the app. This will help you stay informed about your loan status, track your payments, and avoid any discrepancies or issues.

Conclusion:

The EDB Home Finance designed to make the homeownership journey easier and more convenient for United Arab Emirates citizens and families. With its seamless home finance application process, flexibility in managing loan terms, easy access to liability certificates, and transparent loan statement and direct debit schedule downloads, the app offers a range of features to meet the diverse needs of users. By utilizing the playing tips provided, users can make the most out of the app's functionalities and achieve their dream of homeownership efficiently. Download the EDB Home Finance app today and experience a hassle-free home finance journey.