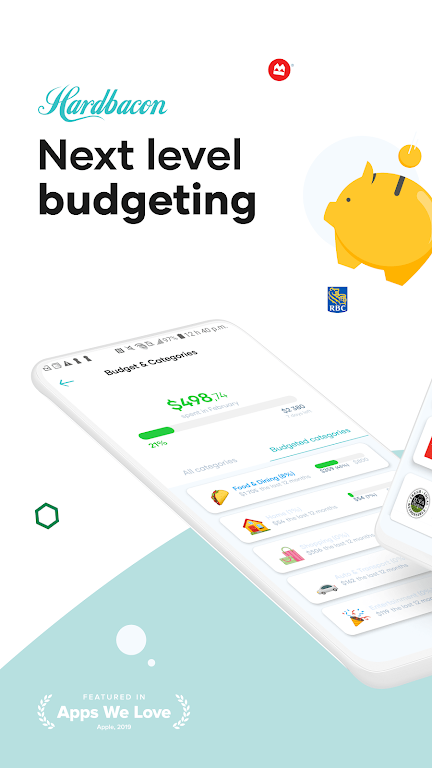

Take control of your finances with Hardbacon: Monthly Budget App, the ultimate monthly budget app. Say goodbye to financial stress as Hardbacon helps guide you towards your financial goals. Connect your bank accounts and credit cards to get real-time insights on the best financial decisions for you. Plus, Hardbacon goes the extra step by helping you find the best credit cards, chequing and savings accounts, mortgages, online brokers, robo-advisors, and insurance policies. Download the app now!

Features of Hardbacon: Monthly Budget App:

Bank account connection: Hardbacon allows you to connect your bank accounts and credit cards to get a clear view of your financial situation.

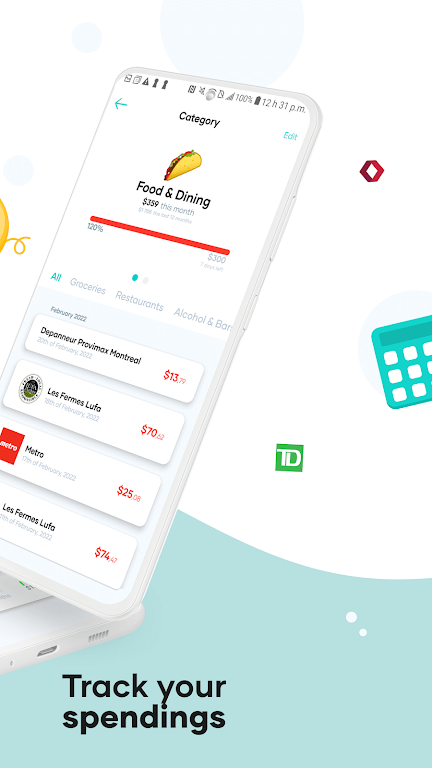

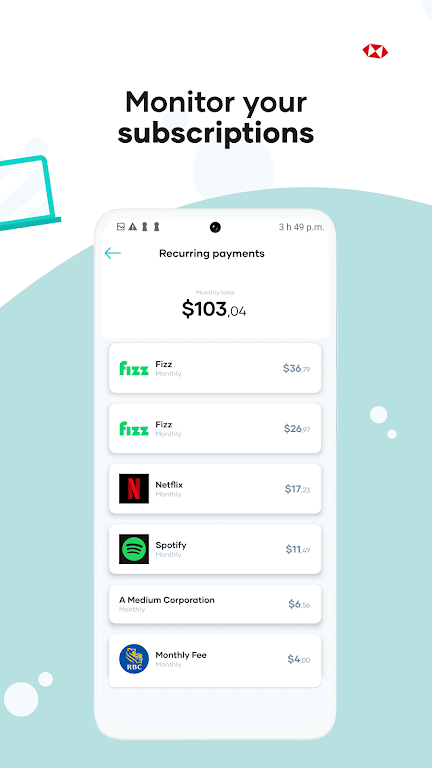

Expense tracking: The app provides a detailed breakdown of your spending habits, showing you where your money is going, such as specific stores or categories.

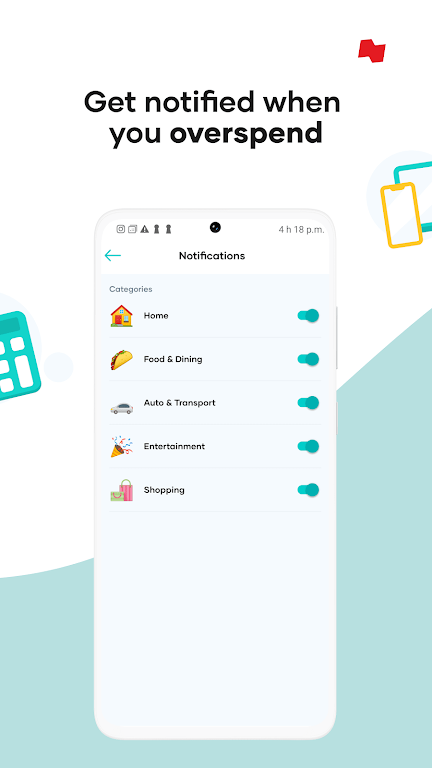

Budget setting: Hardbacon allows you to set monthly spending limits for different categories, helping you stay on track and achieve your financial goals.

Real-time insights: By connecting to your accounts, Hardbacon provides real-time insights on your financial decisions, allowing you to make smarter choices.

Tips for Users:

Regularly check your expense breakdown: Keeping track of your spending habits will help you identify areas where you can cut back and save.

Set realistic budget limits: Be sure to set monthly limits that align with your financial goals and ensure they are achievable.

Review the app's recommendations: Take advantage of the app's financial tips and exclusive offers to maximize your savings and investments.

Conclusion:

With Hardbacon: Monthly Budget App, you can gain control over your finances and work towards achieving financial independence. By connecting your bank accounts, tracking expenses, and setting budget limits, the app helps you make informed financial decisions. Whether you're aiming to save for a specific goal or want to closely monitor your spending, Hardbacon provides the necessary tools and insights to help you achieve your ambitions. Start using Hardbacon today and take the first step towards financial empowerment.