Looking for a hassle-free and efficient way to secure a personal loan? Look no further than Afinoz, India's trusted financial marketplace. With it, you can easily find and compare personal loan options that best suit your needs, all without the need for physical documentation or lengthy verification processes. Whether you're a salaried individual or self-employed, our marketplace offers flexible loan amounts, customizable EMI tenures, and competitive interest rates to ensure a seamless borrowing experience. Get started today!

Features of Afinoz:

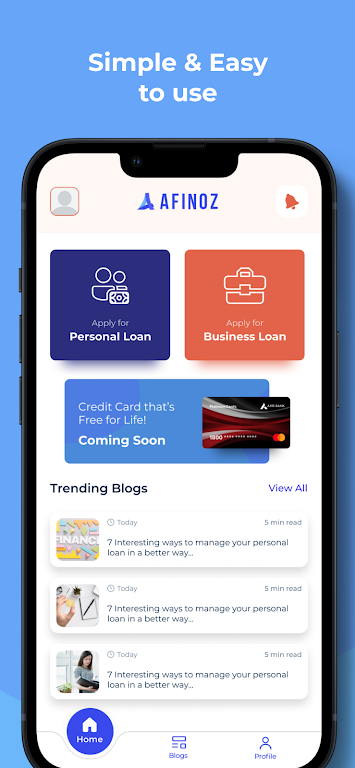

- Wide Range of Loan Types: The app offers a variety of personal loan options to suit different needs. Whether you need funds for a holiday, home renovation, credit building, wedding, or travel, it has got you covered. With a personal loan from it, you have the flexibility to spend the money on anything you want.

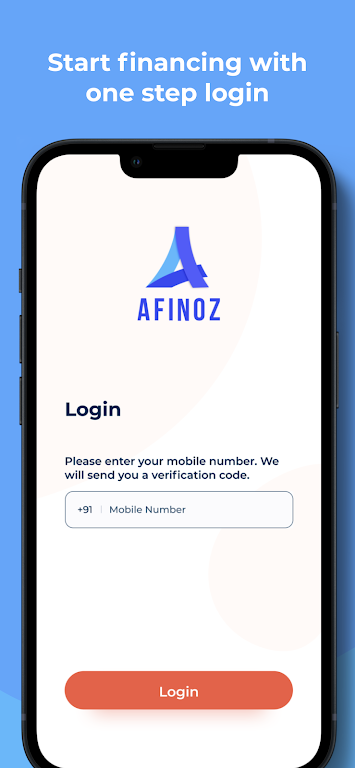

- Fast and Convenient Application Process: Applying for a personal loan through the app is quick and hassle-free. You can complete the entire process within a few hours, without the need for any physical documentation or verification. Simply browse the marketplace, compare loan options, and apply directly through the app.

- Expert Assistance: It has a team of financial experts ready to assist you with any personal loan queries. Whether you need guidance on loan eligibility, repayment terms, or interest rates, the team is there to help. You can expect prompt and accurate responses to ensure a seamless and smooth loan application process.

- Multiple Lending Partners: It has partnered with multiple money lenders, ensuring that you have a wide range of options to choose from. This gives you the opportunity to find the best loan terms and interest rates that suit your financial needs.

Tips for Users:

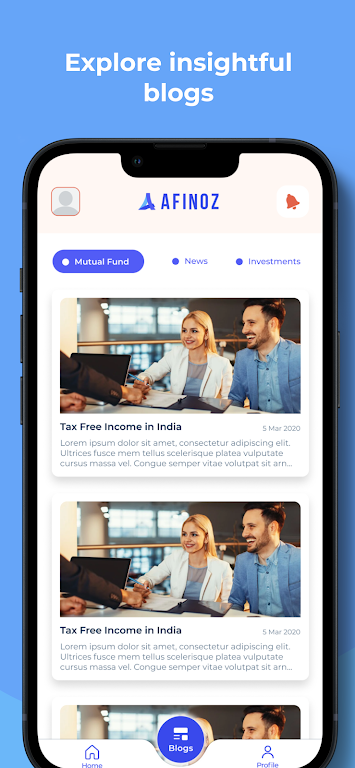

- Research and Compare: Before applying for a personal loan through the app, take the time to research and compare the different loan options available. Consider factors such as interest rates, repayment terms, and processing fees to make an informed decision.

- Check Eligibility Criteria: Make sure you meet the eligibility criteria set by it and its lending partners before applying for a loan. This includes factors such as age, employment history, and minimum income requirements. By ensuring you meet the criteria, you increase your chances of loan approval.

- Read the Fine Print: Before accepting a loan offer through the app, carefully read and understand all the terms and conditions. Pay close attention to the interest rates, repayment periods, and any additional fees or charges. It's important to fully understand the loan terms before committing to avoid any surprises later on.

Conclusion:

If you're in need of a personal loan, the Afinoz app is a reliable and convenient platform to explore. With a wide range of loan types, fast application process, expert guidance, and multiple lending partners, it ensures that you have access to the best loan options available. By following the playing tips of researching, checking eligibility criteria, and reading the fine print, you can make the most informed decisions when applying for a loan through the app. Simplify your personal loan journey and achieve your financial goals with it.