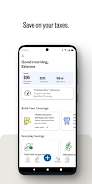

Introducing Stride, the completely free expense and mileage tracker app designed for self-employed individuals. With Stride, you can automatically track your business miles and expenses, helping you save thousands on your tax bill. This mileage tracker helps you discover business expenses that can be claimed as an independent worker, making filing a breeze. By using Stride's expense and mileage tracker, most people save $4,000 or more at tax time. Additionally, Stride's features include automatically maximizing mileage deductions, finding money-saving write-offs, and generating IRS-ready tax reports for easy filing. Perfect for rideshare drivers, delivery drivers, entertainers, and many more professions, Stride is a must-have app for anyone looking to save money and streamline their tax filing process.

Features of the Stride: Mileage & Tax Tracker App:

- Mileage Tracking: The app automatically tracks your business miles, helping you maximize your deductions and save on taxes.

- Expense Tracking: You can log expenses like car washes and cellphone bills, making it easier to claim deductions.

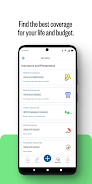

- Money-Saving Write-Offs: The app finds all the expenses and deductions based on the work you do, potentially saving you hundreds of dollars each week.

- IRS-Ready Tax Reports: Stride prepares all the necessary information in IRS-ready reports, making tax filing easy and efficient.

- Reminder System: The app sends reminders to ensure you never miss out on logging miles and expenses.

- User-Friendly Interface: The app offers in-app guidance on which expenses you can deduct and how to best track them, and also integrates with your bank for easy expense import.

In conclusion, the Stride: Mileage & Tax Tracker App is a highly useful tool for individuals who work for themselves. It helps users automatically track and maximize their deductions, ultimately saving them money on taxes. The app offers a user-friendly interface and provides in-app guidance, making it easy for anyone to use. With its features like expense tracking, mileage tracking, money-saving write-offs, IRS-ready reports, and reminders, the app streamlines the process of filing taxes.