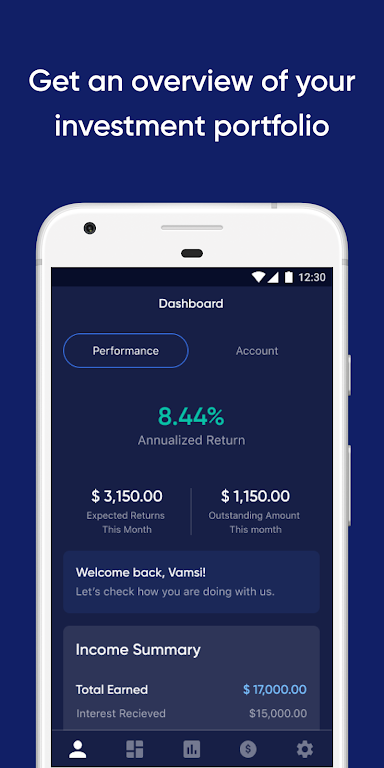

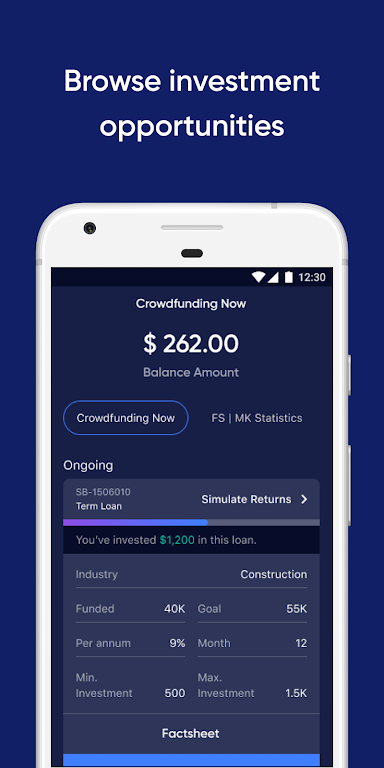

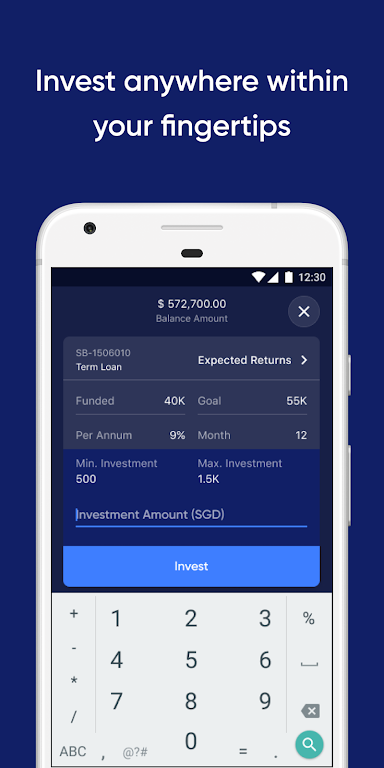

Funding Societies | Modalku is the leading P2P lending platform in Southeast Asia, revolutionizing the way individuals and institutions invest in small and medium-sized enterprises (SMEs). With no minimum balance and a low minimum investment amount, investors have the opportunity to diversify their portfolios by investing in creditworthy local SMEs. Backed by reputable institutions like SGInnovate and Softbank Ventures Asia Corp, Funding Societies has already facilitated over S$1.83B in business loans. Offering guaranteed returns, property-backed investments, dealer financing, and more, this app ensures that investors have access to a variety of investment options. Sign up in just four easy steps and start reaping the benefits of P2P lending with Funding Societies | Modalku.

Features of Funding Societies:

Diversification: Funding Societies offers an opportunity for investors to diversify their investment portfolio by investing in creditworthy local SMEs. This allows investors to spread their risk across multiple businesses and industries.

Low Minimum Investment: With a minimum investment amount of S$20 in Singapore, RM100 in Malaysia, and Rp 00 in Indonesia, it provides an accessible platform for both individuals and institutions to start investing.

Guaranteed Returns: Funding Societies offers guaranteed returns on certain investment products, such as property-backed investments. This provides investors with a level of security and assurance on their investment.

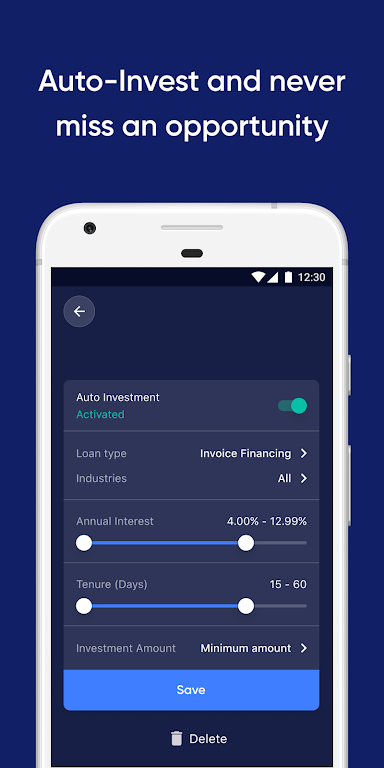

Auto Invest Feature: The platform allows investors to set up an Auto Invest or Planned Funding feature, which automatically deploys funds based on their investment preferences. This saves time and allows for quick reinvestment.

Tips for Users:

Conduct Due Diligence: Before investing, it is important to conduct thorough research and due diligence on the SMEs and investment products available on the platform. This helps investors make informed decisions and choose investments that align with their risk appetite.

Utilize Auto Invest: Take advantage of the Auto Invest feature to automate the investment process. Set your investment preferences and let the system automatically deploy funds for you, ensuring a seamless and efficient investing experience.

Diversify Your Investments: Spread your investments across different SMEs and investment products to minimize risk and maximize returns. Diversification is a key strategy in building a balanced and resilient investment portfolio.

Conclusion:

Funding Societies is the largest P2P lending platform in Southeast Asia, offering attractive opportunities for investors to diversify their portfolio, earn guaranteed returns, and start investing with low minimum amounts. With features like Auto Invest and a wide range of investment products, investors can easily manage and grow their investments. However, it is essential for investors to conduct due diligence and diversify their investments to mitigate risks. With its strong reputation and backing from reputable investors, it provides a reliable platform for investors looking to participate in the flourishing SME lending market in Southeast Asia.