Introducing Zada Cash - Efectivo Zada, the ultimate digital credit platform that provides quick and convenient online loans to users in Mexico. With Zada Cash, customers have the flexibility to choose their loan term of up to 120 days, ranging from $500 to $20,000 pesos. The interest rates are incredibly low, with a daily rate of just 0.09% and a maximum annual interest rate of 33%. On top of that, the commission and VAT charges are minimal, making it an affordable option for borrowers. Say goodbye to time-consuming paperwork and credit bureaus, and say hello to Zada Cash for all your urgent financial needs.

Features of Zada Cash - Efectivo Zada:

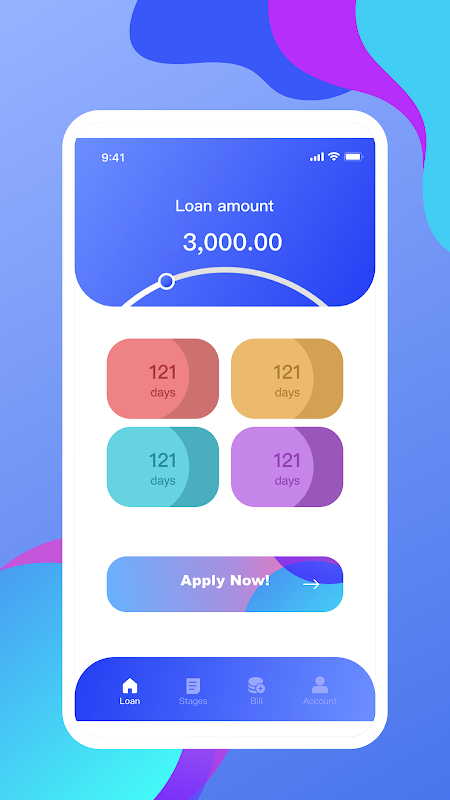

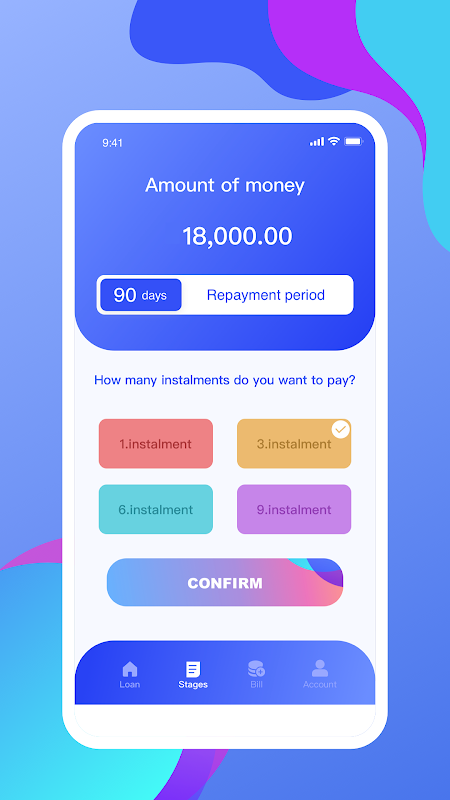

⭐ Flexible Loan Terms: It allows customers to choose the length of their loan term, with options ranging from 91 to 120 days. This provides flexibility for borrowers to select a repayment plan that suits their financial situation.

⭐ Competitive Interest Rates: It offers a daily interest rate of 0.09% and a maximum annual interest rate of 33%. These rates are competitive compared to other digital credit platforms, ensuring that borrowers can access funds at reasonable costs.

⭐ Loan Amount: It provides loans ranging from $500 to $20,000 pesos. This wide range allows borrowers to obtain the amount they need to address their financial needs, whether it's for an emergency expense or to cover regular bills.

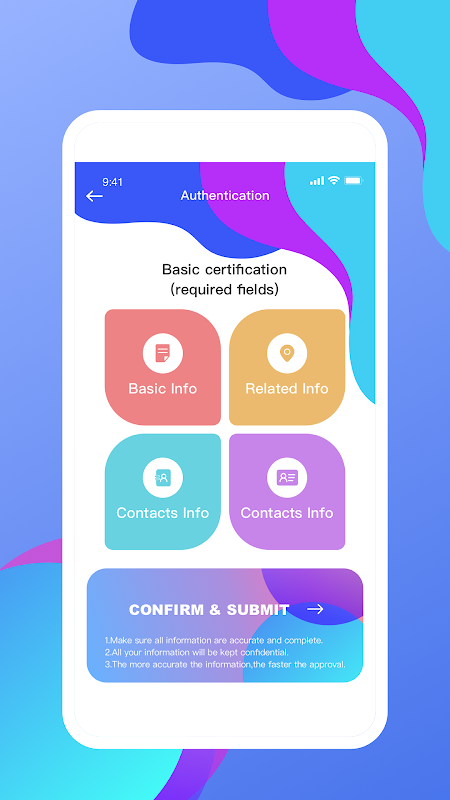

⭐ Simple Application Process: It prides itself on offering a simple and safe online loan service. The application process is hassle-free and can be completed entirely online, saving borrowers time and effort.

Tips for Users:

⭐ Calculate Loan Repayment: Before applying for a loan on Zada Cash, it's important to use the provided example or the online loan calculator to estimate the total repayment amount. This will give borrowers a clear understanding of the cost and help them plan their finances accordingly.

⭐ Choose the Right Loan Term: Take the time to consider your financial situation and choose the loan term that best fits your needs. While longer terms may result in lower monthly payments, remember that the total cost of the loan may be higher due to interest and fees.

⭐ Repay on Time: To avoid additional charges and penalties, make sure to repay the loan on time. Zada Cash provides flexibility in loan terms, but timely payments will help maintain a good credit history and may also improve your chances of obtaining future loans.

Conclusion:

Zada Cash - Efectivo Zada is an excellent digital credit platform that offers flexible loan terms, competitive interest rates, and a simple application process. Their range of loan amounts allows borrowers to access funds for various financial needs, while the provided playing tips help users make informed decisions and manage their loans responsibly. With its commitment to convenience and customer service, Zada Cash is a reliable option for individuals seeking urgent financial assistance in Mexico. Don't hesitate to take advantage of their services and experience the ease and efficiency of their online loan service.