Introducing the SIDBIREA App, the ultimate solution for the promotion, financing, and development of MSMEs in India. As the principal financial institution in the country, SIDBI has become a trusted one-stop institution that caters to the diverse credit needs of the MSME sector. With a range of specialized fund based and non-fund based financial products, SIDBI aims to enhance productivity and competitiveness in this vital sector. Join SIDBI in its mission to create a sustainable future for MSMEs and drive the growth of the Indian economy.

Features of SIDBIREA:

⭐ Comprehensive Financing Solutions: It offers a wide range of financial products and services tailored specifically for the MSME sector. Whether businesses need working capital, term loans, or assistance with project funding, SIDBI has the expertise and resources to cater to their unique needs.

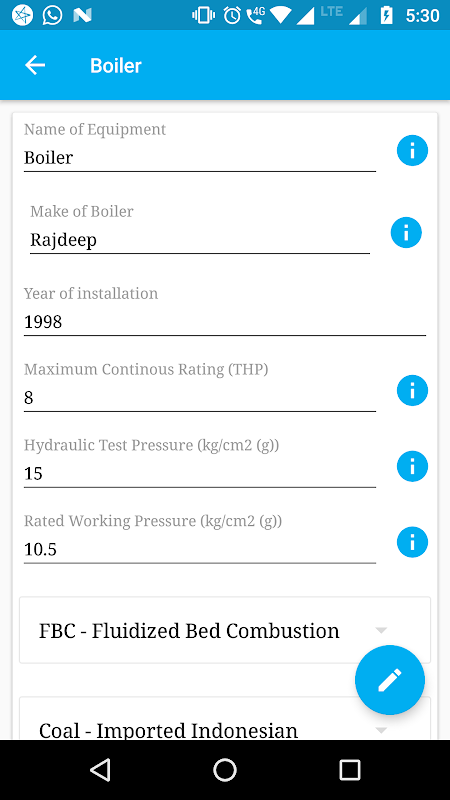

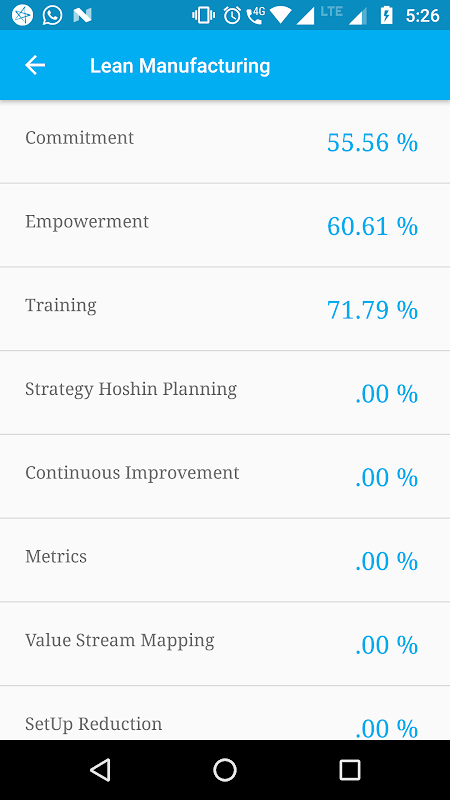

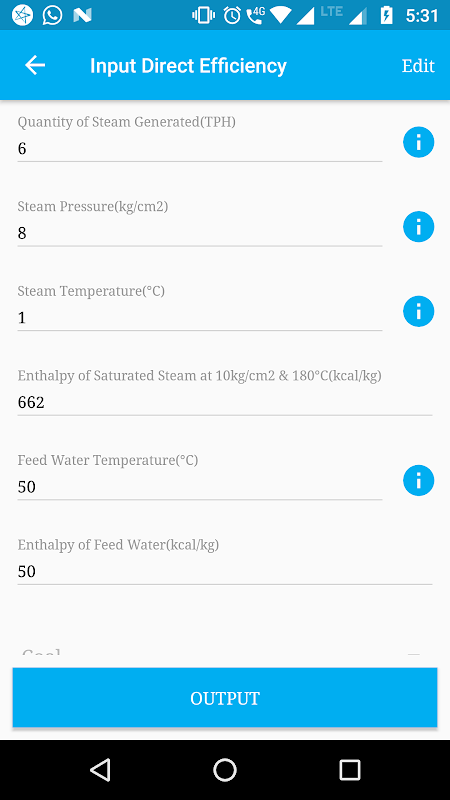

⭐ Focus on Energy Efficiency: It recognizes the importance of sustainable development and actively promotes energy-efficient and green technologies. By providing loan assistance for energy efficiency and cleaner production projects, SIDBI helps MSMEs reduce their carbon footprint and improve their competitiveness.

⭐ Strong Partnerships: It has established strategic partnerships with international organizations such as Japan International Cooperation Agency (JICA), KfW, AFD, and the World Bank. These partnerships enable SIDBI to leverage additional financial resources and expertise to support the growth and development of the MSME sector.

⭐ Developmental Initiatives: In addition to its financing solutions, SIDBI is actively involved in implementing various developmental initiatives. Programs like the End-to-End Energy Efficiency (4E) Programme and the Partial Risk Sharing Facility (PRSF) Project provide additional support and resources to help MSMEs thrive in a competitive market.

FAQs:

⭐ Can startups and newly established businesses benefit from SIDBI's financing solutions?

- Yes, it caters to the financing needs of MSMEs at every stage of their journey, including startups and newly established businesses. They offer specialized products that cater to the unique requirements of these businesses.

⭐ How can MSMEs apply for financing from SIDBI?

- MSMEs can apply for financing from SIDBI through their various partner banks and financial institutions. These institutions have tie-ups with SIDBI and facilitate the loan application process on behalf of the MSMEs.

⭐ Does it provide support beyond financial assistance?

- Yes, it goes beyond financial assistance and actively implements developmental initiatives to support the growth and development of MSMEs. These initiatives provide additional resources, knowledge, and expertise to help MSMEs improve their productivity and competitiveness.

Conclusion:

SIDBIREA, as the principal financial institution for the promotion, financing, and development of MSMEs in India, offers a comprehensive range of financial products and services tailored specifically for the sector. With a focus on energy efficiency and sustainable development, it actively promotes green technologies and provides loan assistance for energy-efficient projects. Through strategic partnerships and various developmental initiatives, SIDBI aims to support the growth and competitiveness of MSMEs in India. Whether businesses need financing for working capital, term loans, or project funding, SIDBI is the go-to institution that provides specialized solutions for the unique requirements of MSMEs.