myRAMS Mobile Banking is a user-friendly app that provides customers with a fast, simple, and secure way to manage their finances. With its intuitive design, accessing key functions and checking account balances, transactions, and details has never been easier. The app also allows users to schedule and manage payments, transfer money between accounts, and even estimate affordability and stamp duty using handy calculators. Stay informed about our range of loans for first-home buyers and self-employed individuals, as well as online savings and transaction accounts.

Features of myRAMS:

⭐ Faster, Simpler, and More Consistent Experience: myRAMS Mobile Banking offers a streamlined and efficient mobile banking experience that is easy to navigate, allowing customers to access their accounts quickly and perform transactions seamlessly.

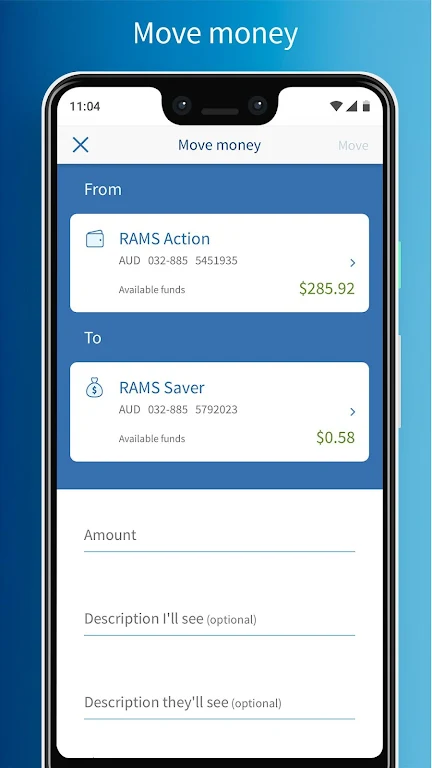

⭐ Separate BPAY and Payee Limits: This feature allows users to set separate limits for BPAY transactions and Payee transfers, providing greater control over their payments.

⭐ Intuitive Design: The app's intuitive design ensures that users can easily find and access key functions, making banking tasks simpler and faster.

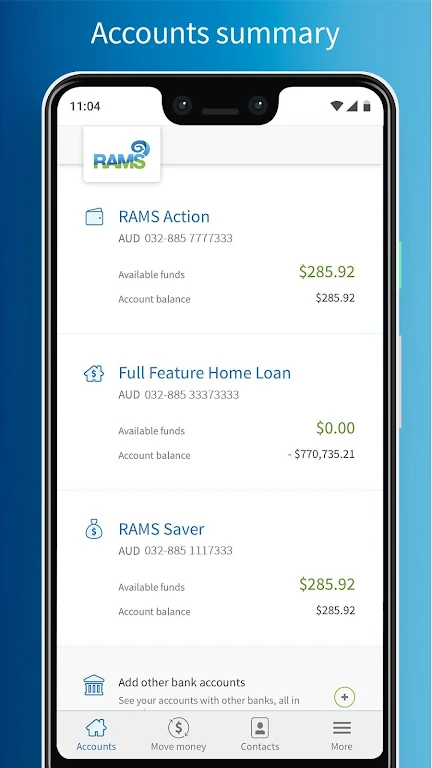

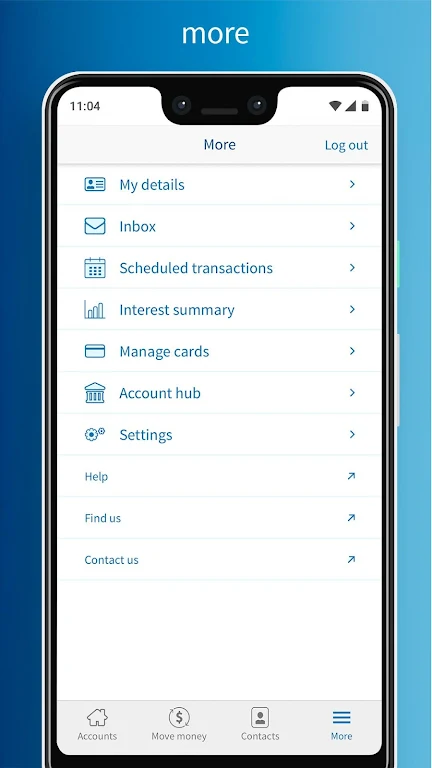

⭐ Comprehensive Account Management: Users can check their account balances, view transaction history, and manage account details conveniently from within the app. They can also schedule and manage payments, including BPAY transactions and transfers between different accounts and payees.

Tips for Users:

⭐ Set Up 4-Digit PIN: Take advantage of the quick logon feature by setting up a 4-digit PIN for logging in to the app. This will save you time and make accessing your account faster and more convenient.

⭐ Use Separate BPAY and Payee Limits: Utilize the separate limits for BPAY transactions and Payee transfers to effectively manage your payments and stay within your preferred limits for each type of transaction.

⭐ Explore Calculators: Make use of the calculators available in the app to estimate affordability, repayments, stamp duty, and more. This will help you make informed financial decisions and plan your finances effectively.

⭐ Stay Updated: Keep in mind that the information provided in the app is current at the time of download and is subject to change. Regularly check for updates to ensure that you have the most up-to-date information regarding fees, conditions, limitations, and lending criteria.

Conclusion:

myRAMS Mobile Banking offers a user-friendly and secure mobile banking experience. With its faster, simpler, and more consistent features, users can easily access key functions, manage their accounts, and perform transactions efficiently. The separate BPAY and Payee limits provide greater control over payments, while the intuitive design ensures a seamless user experience. By utilizing the app's features and following the playing tips, users can make the most of their mobile banking experience and effectively manage their finances. Stay updated with the latest information to ensure you have the most accurate details regarding fees, conditions, and lending criteria.