Introducing MyTuron, the ultimate mobile banking app designed to make your financial transactions quicker and more convenient than ever before. With MyTuron, you can easily access information about your account balances and transactions, transfer funds between accounts, repay your consumer loans, and make hassle-free payments for retail services, utilities, mobile operators, and internet providers. You can even set up transaction templates for your recurring payments. Don't miss out on this incredible opportunity - subscribe to Turonbank Internet Banking and experience banking at your fingertips.

Features of MyTuron:

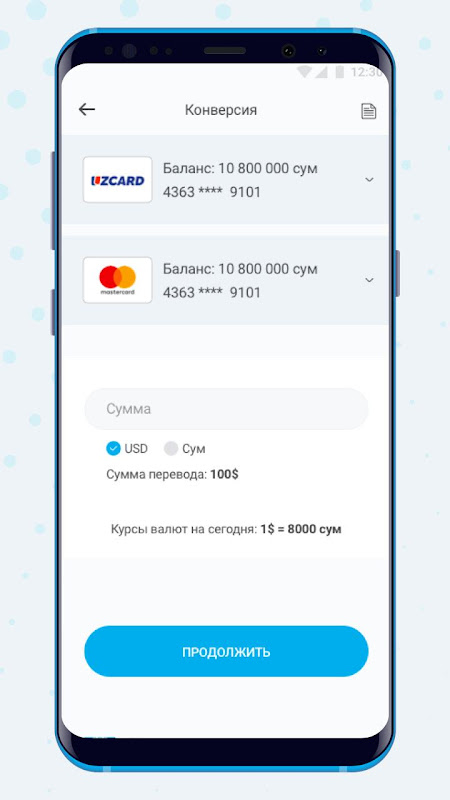

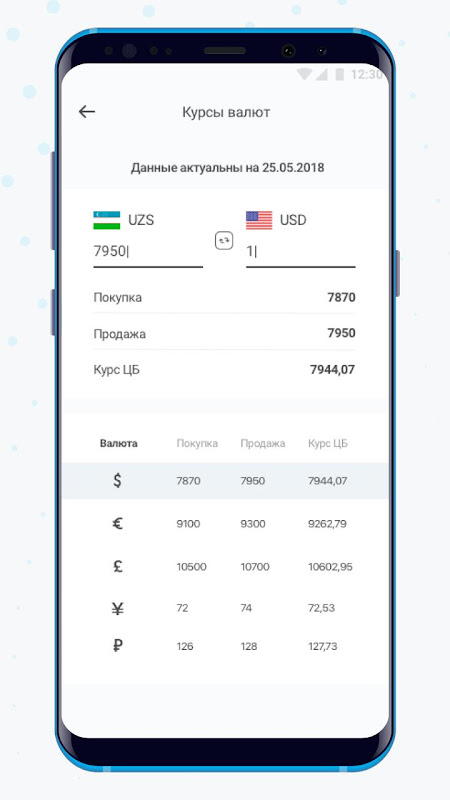

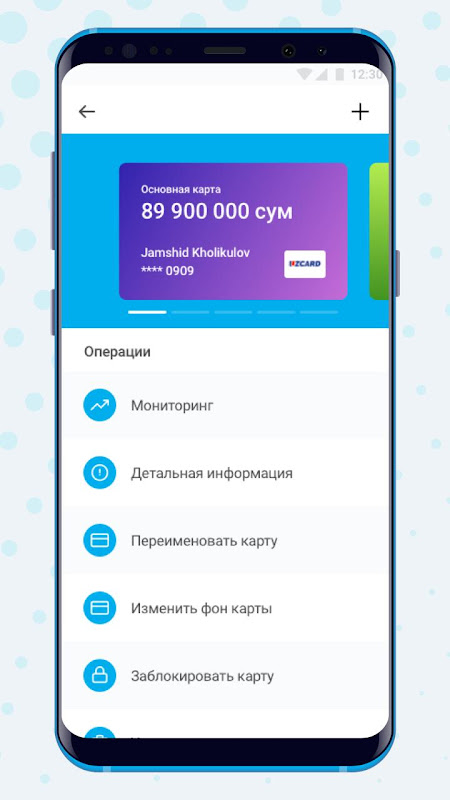

* Convenient and Secure Banking Operations: It offers a range of banking operations that can be conveniently performed through mobile communications. Users can easily access information on their account balances and transaction history, transfer funds between accounts, repay loans, make payments for various services such as retail, utilities, mobile operators, and internet providers, and more. All these transactions can be completed securely through the app, providing peace of mind to users.

* Online Microloan with Ease: One of the standout features of it is the introduction of an online microloan. This loan option is available to holders of plastic cards from JSCB "Turonbank" for salary payments. The process of obtaining the microloan is hassle-free as there are no document requirements, no specific intended use for the loan, and no human factor involved in the loan approval process. This makes it a quick and convenient solution for those in need of financial assistance.

* Favorable Loan Terms: The online microloan offered through it comes with attractive terms. The loan has a three-month term, and the interest rate is set at 36% per annum. The maximum loan amount is determined based on an automated scoring analysis. It is calculated as 50% of the average monthly salary received on the card, with any existing loan debts deducted. However, the loan amount cannot exceed 10 times the minimum wage. These favorable terms make the microloan an enticing option for users in need of short-term financial support.

* Subscription to Turonbank Internet Banking: Before utilizing the services offered by it, users are required to subscribe to the Turonbank Internet Banking service. This service ensures that users have a secure and convenient platform to access their banking information and perform various transactions. By subscribing to the internet banking service, users can gain full access to the array of features offered by MyTuron and take advantage of the convenient banking operations available.

FAQs:

* Can I use it if I am not a client of JSCB "Turonbank"?

No, it is the official mobile system for providing remote banking services exclusively to individuals who are clients of JSCB "Turonbank".

* How can I apply for an online microloan?

To apply for an online microloan, you need to be a holder of a plastic card from JSCB "Turonbank" for salary payments. Once you meet this requirement, you can easily apply through the app without having to provide any physical documents or specify the intended use of the loan.

* Is the online microloan interest rate competitive?

Yes, the online microloan offered through it is competitive, with an interest rate of 36% per annum. This rate is designed to provide affordable and accessible financial support to users.

Conclusion:

MyTuron provides a comprehensive mobile banking solution with a plethora of attractive features. Users can conveniently and securely perform various banking operations, access account information, transfer funds, pay for services, and more. The introduction of the online microloan sets it apart, offering users a hassle-free loan application process with favorable terms. The subscription to Turonbank Internet Banking ensures a secure platform for users to access their financial information and utilize the services provided by it. With its convenience, security, and valuable features, it is the ideal mobile banking app for individuals looking for seamless banking experiences.