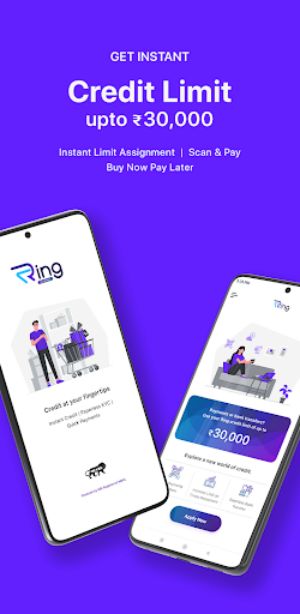

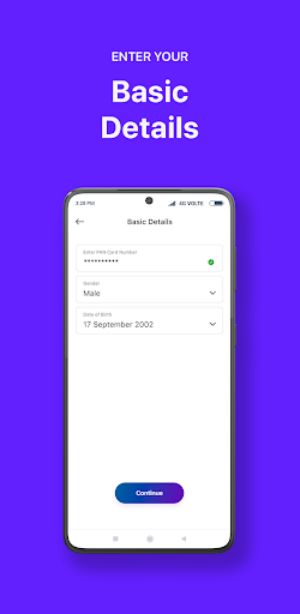

Introducing Ring - Fast and Easy Payments, the game-changing app that revolutionizes the way you make payments. With Ring, you can forget about the hassle of carrying cash or worrying about low bank account balances. Offering instant credit of up to Rs.30,000 at a zero interest rate, Ring allows you to shop and make payments at any merchant or partnered store without deduction from your bank account. No more waiting in long queues or dealing with tedious paperwork – with Ring, you can purchase on credit up to Rs.4,000 without any documentation, interest, or processing fee. Simply scan the QR code and pay on credit with ease. Plus, Ring is a 100% digital, made in India app, so you can rest assured that your payments are secure and convenient. Download Ring today and experience the future of payments!

Features of Ring - Fast and Easy Payments:

> Instant Credit: The Ring app offers instant credit up to Rs.30,000 at a zero interest rate. This means that customers can make purchases at any merchants and Ring partnered stores without having to worry about immediate payment.

> No Need for Bank Account: Customers no longer need to have money in their bank account to make payments. With the Ring app, they can easily scan QR codes and make purchases without getting the money deducted from their bank account.

> Hassle-free Shopping on Credit: Ring allows users to shop on credit without any documentation, interest, or processing fees. Customers can enjoy a credit limit of up to Rs.4,000 and have the opportunity to increase their limit by making timely repayments.

> Wide Acceptance at Merchant Stores: Customers can use their Ring credit at any merchant store that accepts payments from popular UPI apps like BHIM, PhonePe, Paytm, and Amazon Pay. All they have to do is select the "Scan & Pay" option in the Ring app and scan the merchant's QR code.

FAQs:

> How does Ring provide instant credit without any interest rate?

Ring is able to offer instant credit without interest by partnering with various institutions and leveraging their financial infrastructure. This allows customers to make purchases on credit without incurring any additional charges.

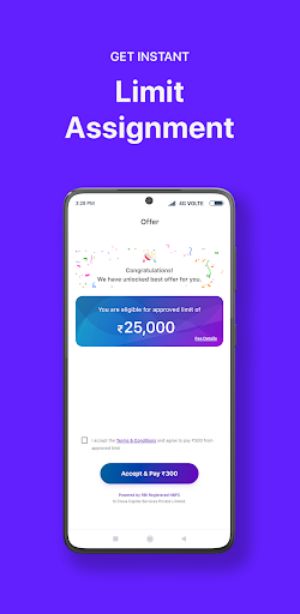

> Is there a limit on the amount of credit I can avail?

Yes, users can avail instant credit up to Rs.30,000. Additionally, they can shop on credit up to Rs.4,000 without any documentation or processing fees.

> How can I increase my credit limit?

To increase your credit limit, it is important to make timely repayments of your previous bills. Ring assesses your repayment history and rewards responsible borrowers with higher credit limits.

Conclusion:

Ring - Fast and Easy Payments eliminates the need for a bank account when making payments, making it convenient for users without access to traditional banking services. With hassle-free shopping on credit and wide acceptance at partner merchant stores, Ring provides a seamless payment experience. It is a user-friendly app that empowers customers to shop and pay on credit with ease.