Instant Personal Loan App - MoneyTap Credit Line is a game-changing app that provides instant personal loans with zero collateral in India. Unlike traditional loan apps, MoneyTap offers the unique benefit of paying interest only on the amount that you withdraw from your MoneyTap balance. With interest rates as low as 13% per year for 3 to 36 months, it combines the advantages of a personal loan and a credit card. This app is perfect for salaried employees with a minimum monthly salary of ₹30,000. With MoneyTap, you can easily manage your finances and have access to funds whenever you need them, without worrying about excessive interest charges.

Features of Instant Personal Loan App - MoneyTap Credit Line:

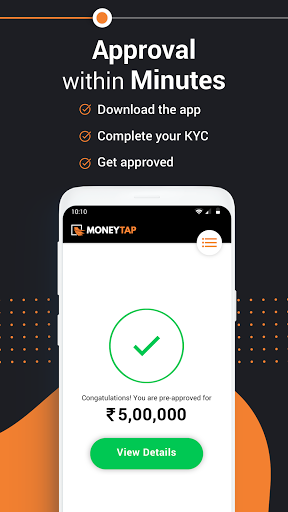

> Instant Approval: MoneyTap offers instant approval for personal loans, allowing users to access funds quickly and easily without the need for lengthy application processes or documentation.

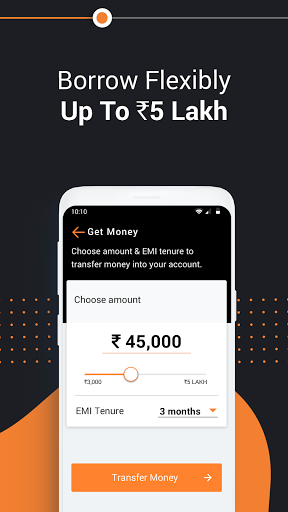

> Flexibility in Repayment: With MoneyTap, users have the flexibility to choose their repayment terms, ranging from 3 to 36 months. This allows borrowers to tailor their monthly payments to their financial situation and ensures that they can comfortably repay the loan without straining their budget.

> Low Interest Rates: MoneyTap offers competitive interest rates starting as low as 13% per year. This makes it an affordable option for borrowers who are looking for personal loans with reasonable interest charges.

> Credit Line Concept: MoneyTap operates on a credit line concept, where users are given a pre-approved credit limit that they can borrow from as per their needs. The best part is that interest is only charged on the amount borrowed, not on the entire credit limit. This provides users with the convenience of having a line of credit available whenever they need it, without having to pay unnecessary interest charges.

> Combined Personal Loan and Credit Card Benefits: MoneyTap combines the benefits of a personal loan and a credit card. Users can borrow funds as per their requirements and use the money as they wish, similar to a personal loan. At the same time, the credit line allows users to make purchases using a card linked to the app, providing them with the convenience and versatility of a credit card.

FAQs:

> Is MoneyTap available only for salaried employees?

Yes, MoneyTap is currently available exclusively for salaried employees who have a minimum monthly salary of ₹30,000.

> Are there any additional fees?

Yes, there is a processing fee of 2% of the borrowed amount, along with GST. Additionally, there is a line setup fee of ₹499 plus GST, which needs to be paid before starting the credit line.

> Can I prepay my loan without any charges?

Yes, you can prepay your loan at any time without any prepayment charges or penalties.

Conclusion:

By providing users with the option to pay interest only on the amount borrowed, MoneyTap ensures affordability and financial flexibility. The app combines the benefits of personal loans and credit cards, making it a comprehensive solution for all your borrowing needs. With competitive interest rates and an easy application process, Instant Personal Loan App - MoneyTap Credit Line is a reliable and user-friendly option for obtaining instant personal loans.