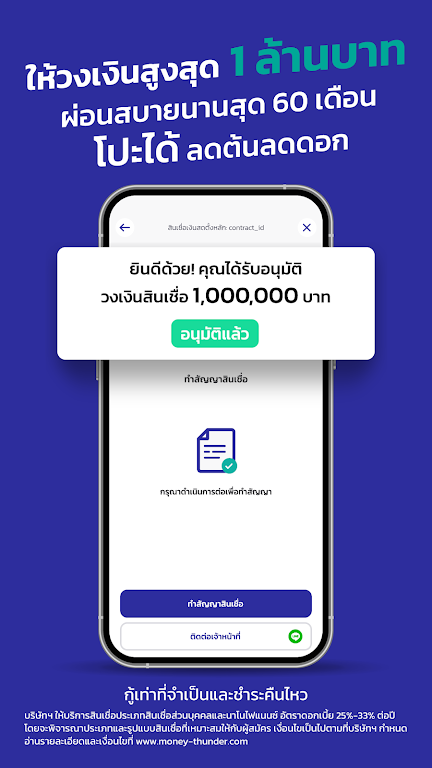

Introducing MoneyThunder: Legal lending, the legal digital lending mobile app that puts cash in your hands quickly and securely. With the backing of SCB Abacus and supervised by the Bank of Thailand, you can trust that your personal data is protected under the Personal Data Protection Act (PDPA). Whether you need a personal loan or a nano finance loan, MoneyThunder has you covered. No collateral, guarantor, or pre-loan fees required. Choose between a revolving credit option with unlimited withdrawals or a term loan with flexible installment payment plans. With 24/7 service and a 10-minute time-to-money, MoneyThunder is the solution for your financial needs.

Features of MoneyThunder: Legal lending:

Legal and Secure - MoneyThunder is a legal lending mobile app supervised by the Bank of Thailand, ensuring that it operates within the boundaries of the law. The app also prioritizes data privacy and security, complying with the Personal Data Protection Act (PDPA). Users can trust that their personal information is safe and confidential.

Instant Loan Decision - With MoneyThunder, you can say goodbye to long waiting times for loan approvals. The app provides an instant loan decision, allowing you to access the cash you need quickly and efficiently. Whether it's an emergency or an unexpected expense, MoneyThunder has got you covered.

Easy Application - Applying for a loan has never been easier. All you need is your ID card, and you're good to go. No complicated paperwork or unnecessary hassle. MoneyThunder makes the process simple and convenient for users, saving you time and energy.

24/7 Availability - Life doesn't stick to a 9-5 schedule, and neither does MoneyThunder. The app is available 24/ ensuring that you can access its services whenever you need them. Whether it's early morning or late at night, MoneyThunder is there for you, ready to assist you with your financial needs.

Tips for Users:

Understand the Loan Types - MoneyThunder offers two loan types: Personal Loan and Nano Finance Loan. Take the time to understand the differences between the two and choose the one that suits your needs best. Familiarize yourself with the credit limits, monthly interest rates, and APR to make an informed decision.

Plan Your Repayments - Proper planning is crucial when it comes to loan repayments. If you opt for the revolving credit option, remember that there is a minimum payment requirement of THB However, for term loans, you have the flexibility of choosing a tenor between 12 to 60 months. Plan your installment payments accordingly to ensure a smooth repayment process.

Stay Updated on Due Dates - It's important to stay on top of your loan repayments. MoneyThunder has due dates set on the 28th of each month. Make sure you mark these dates on your calendar and set reminders to avoid any late fees or penalties. Timely payments will also help you maintain a good credit score.

Conclusion:

With its legal and secure nature, instant loan decisions, easy application process, and round-the-clock availability, it stands out as a must-have for anyone in need of quick cash solutions. By understanding the loan types, planning your repayments, and staying updated on due dates, you can make the most out of this user-friendly app. Don't let financial emergencies or unexpected expenses hold you back. Download MoneyThunder: Legal lending today and experience seamless and efficient lending services at your fingertips.