RECalc Mortgage Calculator is the ultimate app for all your mortgage and loan calculations needs. Not only does it offer a simple and familiar user interface, just like a traditional calculator, but it also provides you with the power to calculate monthly payments, terms, interest rates, and loan amounts for any mortgage or loan. With RECalc, you can even perform standard mathematical calculations just like any other calculator. This app supports both monthly and semi-annual compounding, making it perfect for Canadian amortization. Want to see the complete loan summary and amortization table? Just click a button! Whether you're a real estate professional, mortgage broker, first-time homebuyer, or simply looking to refinance, RECalc is here to make your life easier. And hey, it can even calculate car loan payments too!

Features of RECalc Mortgage Calculator:

> Dual Functionality: RECalc serves as both a real estate mortgage loan calculator and a traditional mathematical calculator. This makes it a versatile tool that can handle various calculations without the need for multiple apps.

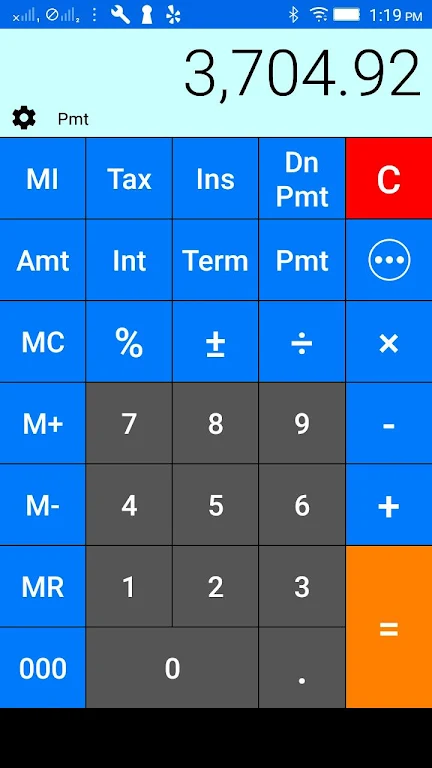

> User-Friendly Interface: The UI of RECalc is designed to be simple and familiar, resembling a traditional calculator. This makes it easy for users to navigate and use the app, even if they are not tech-savvy.

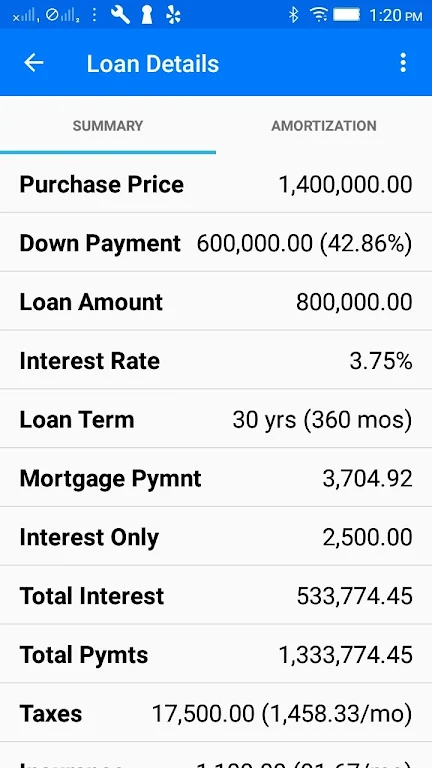

> Comprehensive Mortgage Calculations: With RECalc, users can calculate the monthly payment, term, interest rate, or loan amount for a mortgage or any other loan. It provides accurate and detailed results, giving users a clear understanding of their financial situation.

> Additional Features: In addition to standard mortgage calculations, RECalc also supports semi-annual compounding, known as Canadian Amortization. This feature is particularly useful for individuals or professionals in Canada who need to calculate mortgage payments according to this method.

Tips for Users:

> Familiarize Yourself with the UI: Spend some time exploring the user interface of RECalc to get comfortable with its layout and functions. This will help you navigate the app effortlessly and make accurate calculations.

> Enter the Necessary Data: Ensure that you input all the required information accurately when calculating mortgage payments or other loan details. This includes values such as loan amount, interest rate, term, and down payment amount or percentage.

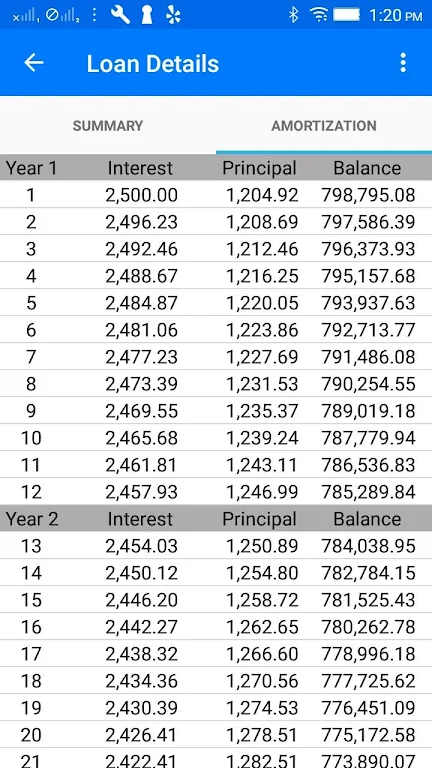

> Utilize the Loan Summary and Amortization Table: Take advantage of the complete Loan Summary and Amortization Table offered by RECalc. These features provide a comprehensive overview of your mortgage or loan, including payment breakdowns over time.

Conclusion:

The user-friendly interface ensures a seamless user experience, even for those with limited technological know-how. The comprehensive mortgage calculations and additional features, such as Canadian Amortization support, further enhance RECalc Mortgage Calculator's value. Whether you need to calculate mortgage payments or car loan payments, RECalc is readily available on your phone, making it a valuable tool for financial planning and decision-making.