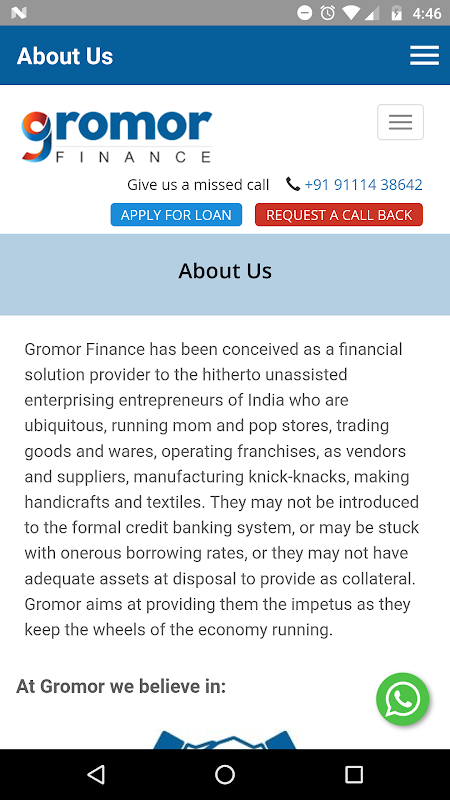

Gromor Finance is a revolutionary app designed specifically for the enterprising entrepreneurs of India. It caters to individuals who run small businesses such as mom and pop stores, franchises, and vendors, but may struggle to access traditional banking services or face high borrowing rates. With Gromor, these entrepreneurs can finally get the financial support they need to keep the wheels of the economy running. The app offers features like a loan account statement, reminder notifications for upcoming repayments, up-to-date application details, and even the ability to review and accept/decline loan proposals. It also provides quick access to back-office services and the option to apply for a top-up loan. We are constantly working to improve and add more features to the app. So, give it a try and let us know your valuable feedback. Here's to a successful future for your business!

Features of Gromor Finance:

❤ Financial Solution Provider for Entrepreneurs: Gromor Finance is specifically designed to cater to the financial needs of enterprising entrepreneurs in India who may have been left behind by the formal credit banking system. It aims to assist small business owners, including mom and pop stores, traders, vendors, and manufacturers, who may struggle with high borrowing rates or lack adequate collateral.

❤ Simplified Loan Account Management: The app offers a comprehensive Loan Account Statement feature that provides a detailed repayment schedule, paid EMI details, and upcoming EMI schedule. This allows users to easily monitor and manage their loan account, making it convenient and hassle-free to stay on top of their finances.

❤ Timely Payment Reminders: To help users stay on track with their loan repayments, the app sends reminder notifications for upcoming EMIs. This ensures that entrepreneurs do not miss any payments, helping them maintain a good credit score and build a strong financial foundation for their business.

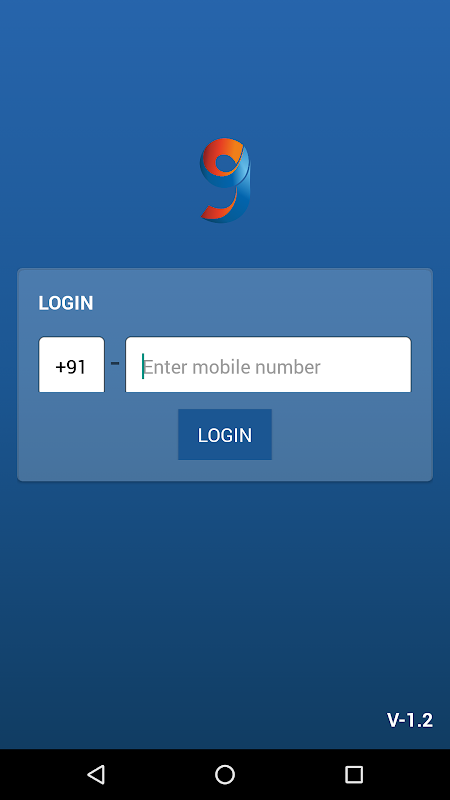

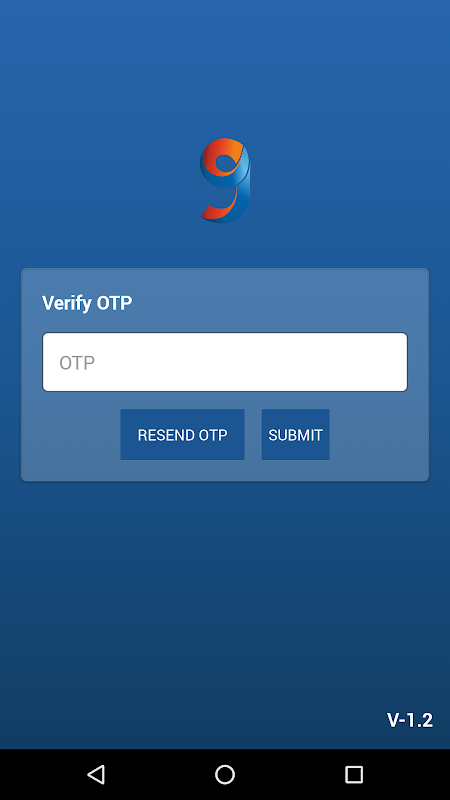

❤ Streamlined Application Process: Gromor Finance streamlines the loan application process by delivering loan proposals directly to users' mobile devices. This allows entrepreneurs to conveniently review and accept or decline loan offers, all within the app. The quick access to these services saves time and effort, making it easier for users to access the funds they need.

Tips for Users:

❤ Regularly Check Loan Account Statement: It is advised to regularly review the Loan Account Statement section to stay updated on repayment schedules and understand the EMI details. This will help users plan their finances effectively and ensure timely repayments.

❤ Set Up EMI Reminders: Utilize the reminder notification feature to set up alerts for upcoming EMIs. This will help in staying organized and avoiding any missed payments. Users can stay on top of their loan obligations and maintain a positive credit history.

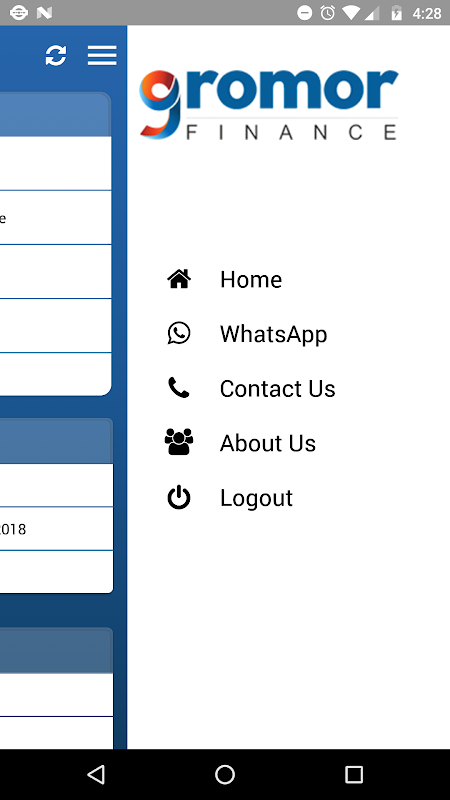

❤ Explore Additional Services: Take advantage of the quick access to back-office services offered by the app. These services can provide additional support and guidance on loan-related queries or any other financial assistance needed for business growth.

Conclusion:

With simplified loan account management, timely payment reminders, and a streamlined application process, the app offers a convenient and efficient way for small business owners to access the funds they need to drive economic growth. By regularly checking loan account statements, setting up EMI reminders, and exploring additional services, entrepreneurs can maximize the benefits of Gromor Finance and ensure the success of their businesses. Download the app now and experience the power of financial independence.