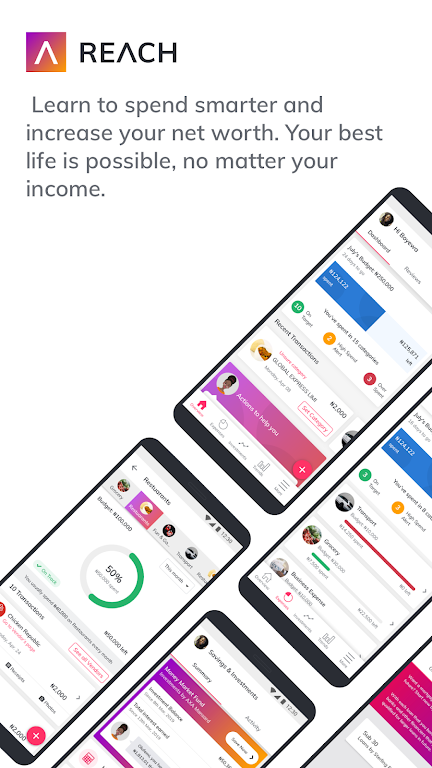

REACH -Track Personal Finances is here to help you achieve your goals. With this app, you can track your personal finances, gain insights into your spending habits, and learn to spend smarter to increase your net worth. See a visual breakdown of where your money goes each week, set up a budget, and stay on track with your financial goals. Need some extra cash? No worries, you can even get a short-term loan in just a few minutes. With military-grade security and a commitment to privacy, REACH has all the tools you need to master your finances and live your best life.

Features of REACH -Track Personal Finances:

- Track Personal Finances: The app allows users to track their personal finances, giving them a clear understanding of where their money is going and how they can improve their financial situation. Whether you have a high income or a low income, this app is designed to help you achieve your best life.

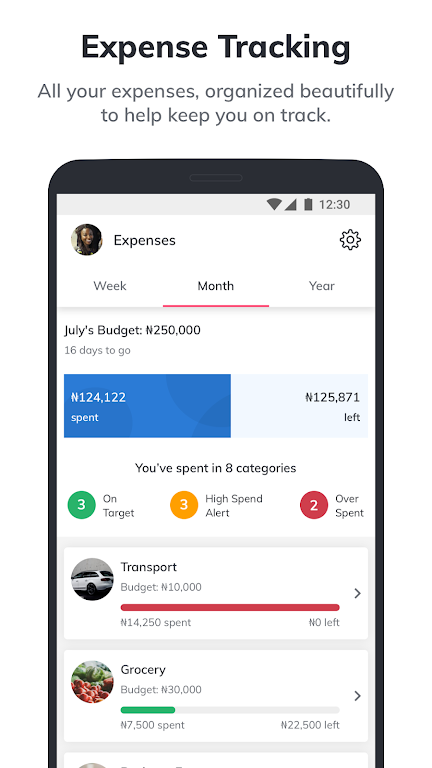

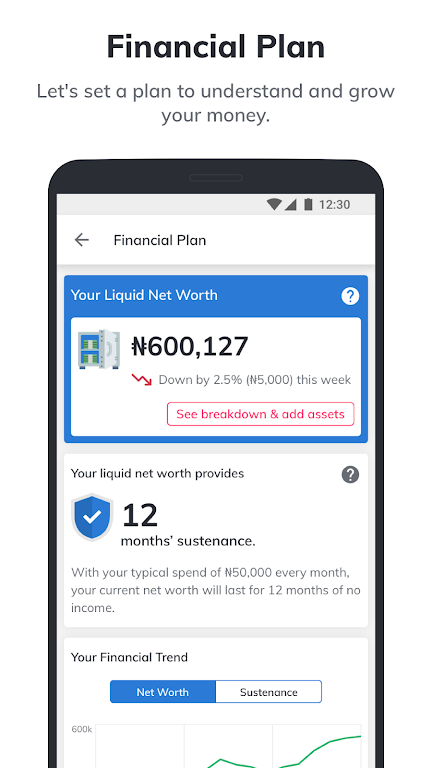

- Increase Net Worth: By providing insights into your spending habits, the app helps you spend smarter and ultimately increase your net worth. With a visual breakdown of your expenses, you can identify areas where you can cut back and save more.

- Financial Freedom: If you consider yourself adventurous, goal-oriented, or dauntless, the REACH app can help you attain the financial freedom to pursue your dreams and hit the bullseye with your badassery. It empowers you to take control of your financial life and make the most of your money.

- Personalized Financial Plan: No matter your financial needs, the app offers a personalized financial plan to guide you. Whether you're short on cash and in need of a short-term loan, or simply want to manage your transactions and budget better, this app has you covered.

Tips for Users:

- Track Income and Expenses: Use the app to automatically or manually track your income and expenses. This will give you a comprehensive overview of your financial situation and allow you to make informed decisions.

- Re-categorize Expenses: Take advantage of the ability to re-categorize your expenses in the REACH app. This feature allows you to better manage your transactions and ensure they are accurately represented in your budget.

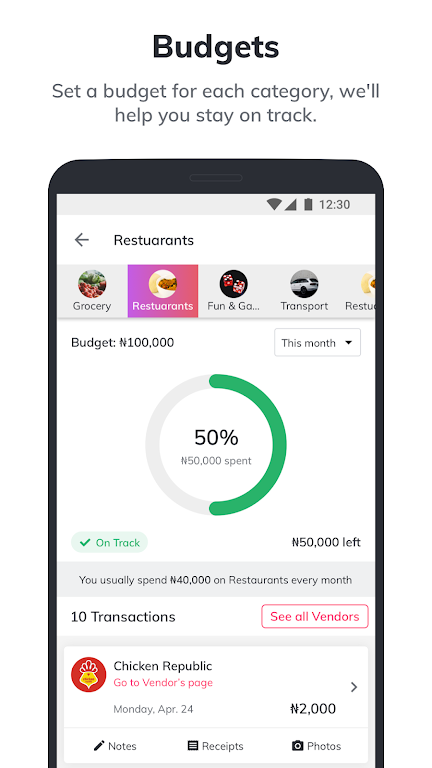

- Set and Stick to a Budget: Utilize the budgeting feature in the REACH app to set financial goals and stay on track. By monitoring your spending and making adjustments, you can avoid going over budget and maintain financial stability.

- Explore Local Businesses: Take advantage of the app's feature to review and discover local businesses. Whether you're looking for recommendations or want to see what others are saying, this can help you make informed spending decisions and support local businesses.

Conclusion:

This app provides a clear and user-friendly interface, allowing you to easily monitor your transactions and adjust your spending to meet your life goals. Whether you need a short-term loan, want to explore local businesses, or simply want to improve your financial situation, REACH -Track Personal Finances is a valuable tool. Rest assured, your data is secure and your privacy is protected, making it a trustworthy choice for managing your personal finances. Download the app today and take control of your financial future.