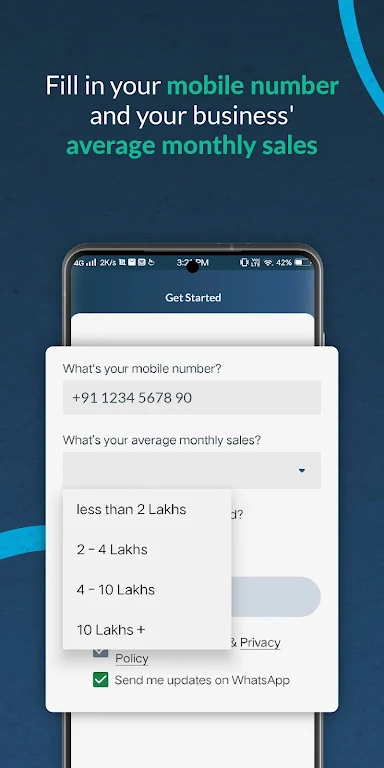

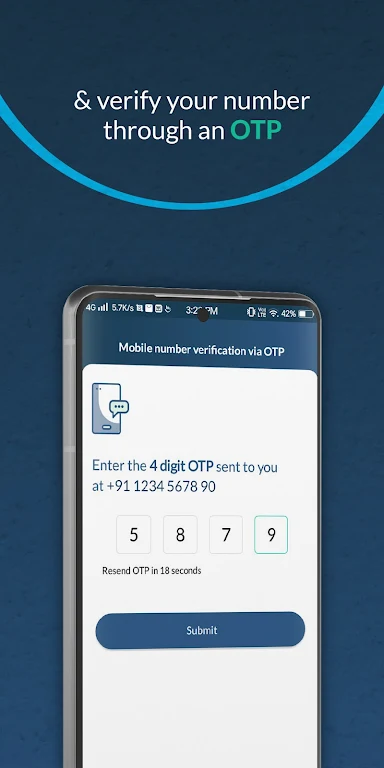

FlexiLoans: Business Loans is a game-changing app designed to cater to the financial needs of micro, small, and medium enterprises (MSMEs) in India. Unlike traditional banks that often make it difficult for small businesses to obtain loans due to strict criteria and lengthy processes, FlexiLoans aims to bridge this financing gap. With a focus on quick and hassle-free access to funds, they offer a range of financial solutions including term loans, invoice discounting, line of credit, and more. The best part? FlexiLoans is 100% digital, meaning no physical documents are required, making it convenient and accessible for all. Don't let financial barriers hinder your business's growth – make use of FlexiLoans and unlock your full potential today.

Features of FlexiLoans: Business Loans:

❤ Easy and hassle-free access to funds: FlexiLoans provides quick and hassle-free access to funds for micro, small, and medium enterprises (MSMEs).

❤ Multiple financial solutions: The app offers a range of financial solutions to meet the diverse needs of businesses, including working capital management, expansion plans, equipment financing, and more.

❤ Loans for specific purposes: FlexiLoans offers term loans, merchant advance loans, invoice discounting loans, line of credit loans, and other types of loans tailored to the specific needs of MSMEs.

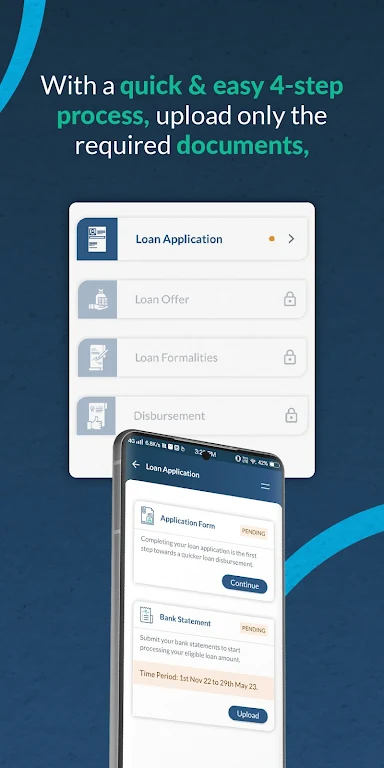

❤ Fast disbursals and flexible repayment terms: The app ensures fast disbursals of loans and offers flexible repayment terms to suit the cash flow of businesses.

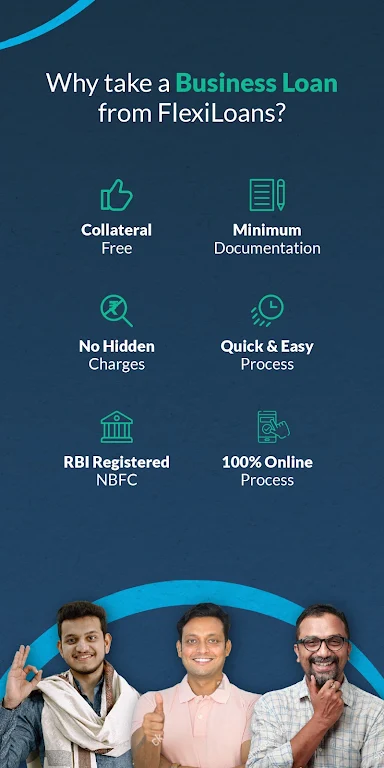

❤ Minimal documentation and no hidden charges: FlexiLoans app requires minimal documentation and does not have any hidden charges.

❤ 100% digital loan app: The app is 100% digital, allowing businesses to apply for loans anywhere and at any time without the need for physical documents.

Conclusion:

With multiple financial solutions, fast disbursals, and flexible repayment terms, FlexiLoans: Business Loans caters to the diverse needs of MSMEs. The app requires minimal documentation and is fully digital, making it convenient for businesses to apply for loans. Click to download the app now and take advantage of its attractive lending rates and customized loans for retailers, traders, restaurants, online sellers, and more.