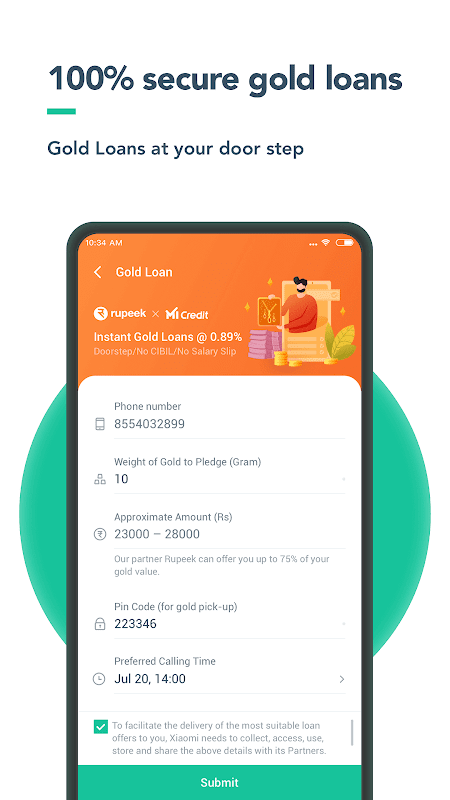

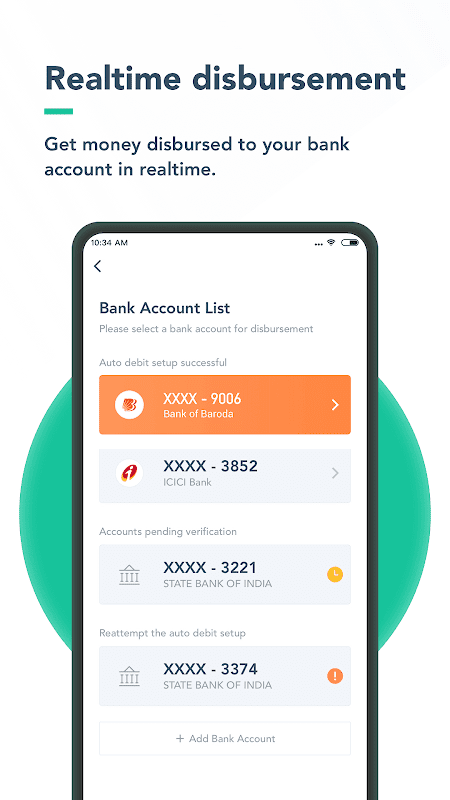

Introducing Mi Credit- Instant Loan App - the ultimate loan app brought to you by Xiaomi, India's leading smartphone brand. With Mi Credit, you can unlock financial freedom by accessing loans up to ₹25,00,000 at incredibly low interest rates. Whether you need a personal, business, or gold loan, Mi Credit has got you covered. Applying for a loan is now simpler and faster than ever before, with a hassle-free digital application process that can be completed right from your mobile phone. Say goodbye to long queues and complicated paperwork - Mi Credit brings convenience and efficiency to your doorstep. Plus, you have the flexibility to choose your EMI tenure, making repayments convenient for you. Need an instant loan? Mi Credit has your back.

Features of Mi Credit- Instant Loan App:

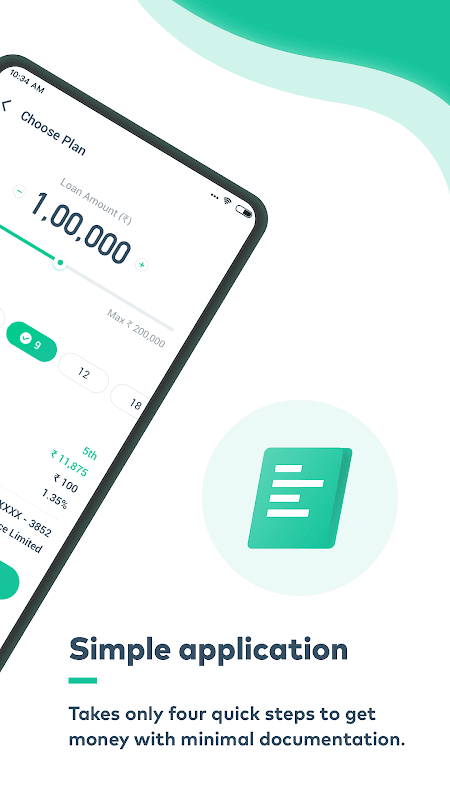

Convenient and Hassle-Free: Mi Credit offers a quick and hassle-free loan application process, allowing users to apply for a loan in just four simple steps. The entire application can be completed digitally, making it convenient for users to apply from anywhere, whether they're at home, in the office, or commuting.

Low Interest Rates: Mi Credit offers competitive interest rates starting from 10% per annum. With such low rates, you can save money on interest payments and make your loan more affordable in the long run.

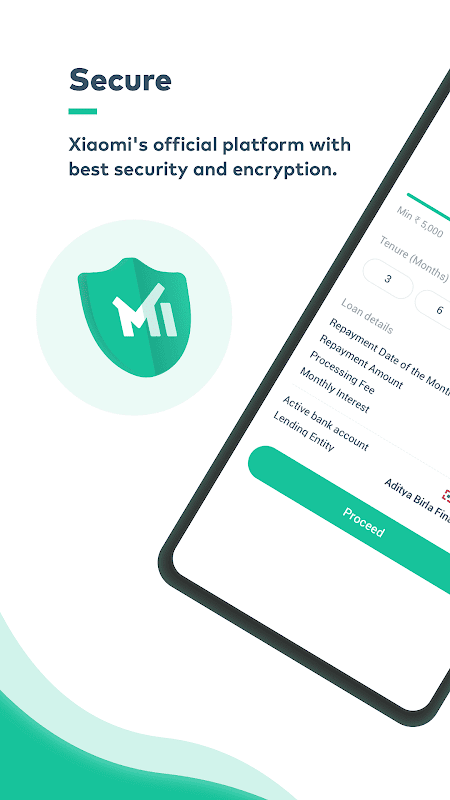

Secure and Reliable: Being the official loan app from Xiaomi, India's #1 Smartphone Brand, Mi Credit ensures the best security practices to keep your personal and financial information safe and secure. You can trust that your data is protected while applying for a loan through the app.

Tips for Users:

Provide Accurate Information: When applying for a loan through Mi Credit, make sure to provide accurate and up-to-date information to increase your chances of approval. Any discrepancies or incomplete details may delay the loan processing or lead to rejection.

Understand the Terms and Conditions: Before accepting a loan offer, take the time to thoroughly read and understand the terms and conditions. Pay attention to the interest rate, repayment tenure, processing fees, and any other associated charges. Being informed will help you make smarter borrowing decisions.

Improve Your Credit Score: Take advantage of this feature to check your credit score and identify areas for improvement. By maintaining a good credit score, you can increase your chances of getting approved for future loans and avail of better interest rates.

Conclusion:

With a quick and hassle-free application process, competitive interest rates, and flexible loan options, Mi Credit- Instant Loan App makes borrowing money easy and affordable. The app also offers the added benefit of checking your credit report for free, helping you maintain a good credit score and improve your chances of being approved for future loans. Trust Xiaomi's official loan app for the best loan offers, reliable security practices, and a seamless borrowing experience.