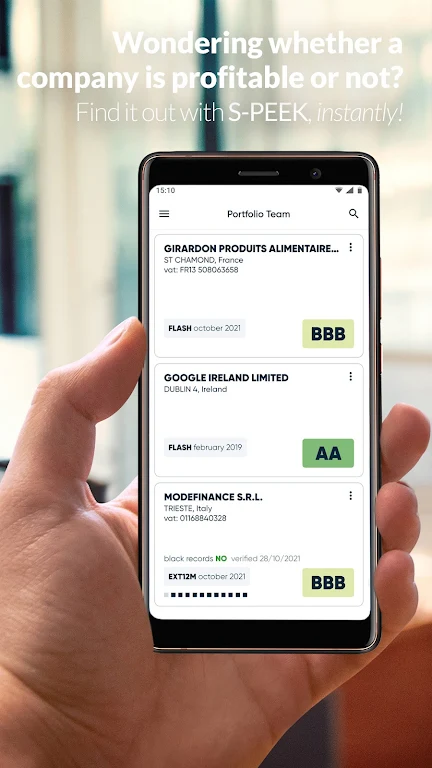

S-peek - Credit Rating is an innovative and user-friendly app that provides valuable insights into the financial health of companies across Europe. Developed by modeFinance, the leading Fintech Credit Rating Agency in Europe, s-peek offers a range of features to help businesses and freelancers assess the creditworthiness of potential clients. With access to over 25 million companies, users can quickly learn about a company's credit rating, commercial credit limit, and other important financial information. The app also allows users to download detailed reports, stay updated on purchased reports, and even read reviews from other users. Whether you're a business owner or a freelancer, s-peek is a must-have tool for making informed decisions about your clients.

Features of s-peek - Credit Rating:

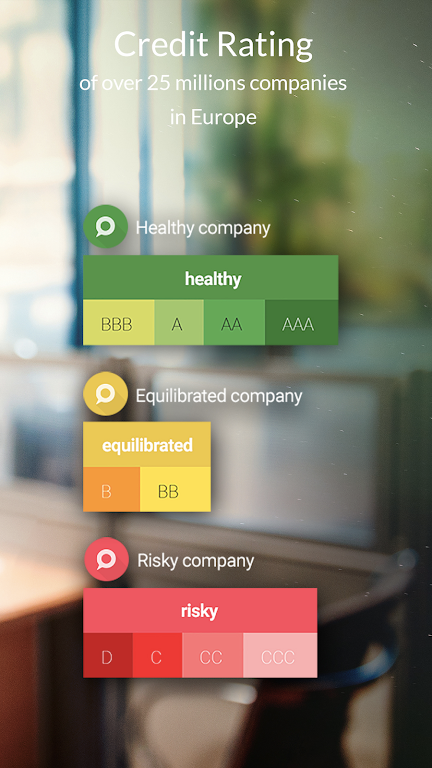

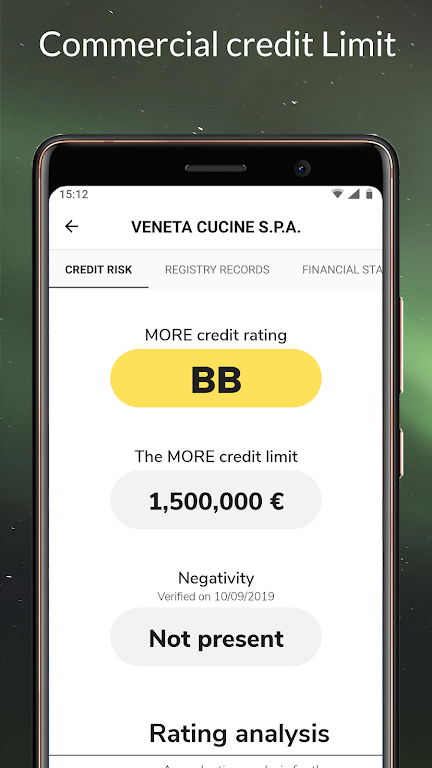

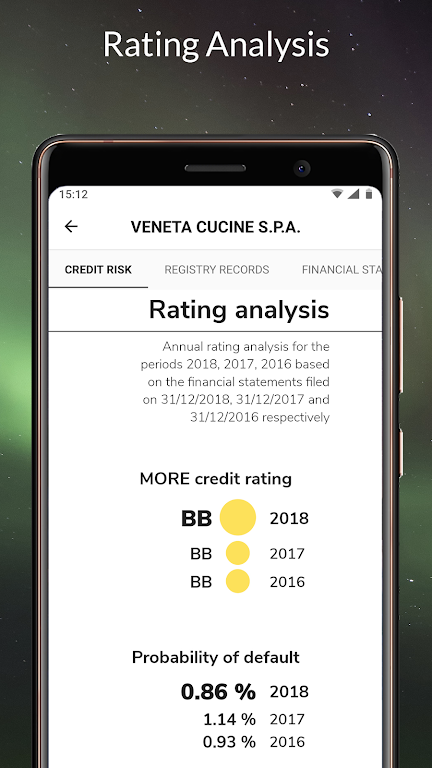

❤ Credit Rating and Commercial Credit Limit: It provides users with instant access to the credit rating and commercial credit limit of any company in Europe. This information helps users assess the financial health and reliability of a potential client or business partner.

❤ Financial Information: The app offers the most important financial data of companies, including details such as turnover, profits, total assets, and shareholders' equity. This allows users to gain a comprehensive understanding of a company's financial performance and stability.

❤ PDF Downloads: Users can download business information in PDF format via the web app. This feature allows for easy sharing and offline access to reports, making it convenient for users to analyze and compare different companies.

❤ Updates on Purchased Reports: S-peek - Credit Rating provides users with updates on purchased reports. This ensures that users have access to the most up-to-date information on the companies they are interested in.

Tips for Users:

❤ Use Credit Rating and Commercial Credit Limit to Assess Risk: When evaluating a potential client or business partner, pay attention to their credit rating and commercial credit limit. A higher credit rating and a larger credit limit indicate a lower risk of default or financial instability.

❤ Analyze Financial Data: Take advantage of s-peek's financial data to analyze a company's performance over time. Look for trends in turnover, profits, and total assets to gauge its stability and growth potential.

❤ Compare Companies: Use s-peek to compare multiple companies within the same industry or sector. This helps you identify strong performers and potential opportunities for partnerships or collaborations.

Conclusion:

With features such as credit rating and commercial credit limit assessments, access to financial data, and PDF downloads, s-peek - Credit Rating provides users with a comprehensive understanding of the financial health of companies. By using s-peek's evaluations and reports, users can effectively assess the creditworthiness and reliability of potential clients or business partners. Stay updated with it and make well-informed decisions for your business success.