Introducing DigiMoney Finance: Loan App, the ultimate solution for quick and hassle-free loans. Say goodbye to long queues at the bank and the endless paperwork involved in getting a loan. With DigiMoney Insta Loan App, the entire lending process is made digital and automated. From user registration to loan disbursement, everything can be done with just a few taps on your phone. What's even better is that the loan is disbursed instantly and credited to your bank account in less than 10 minutes. No more waiting around for days or weeks to get the funds you need. With affordable interest rates and flexible repayment options, DigiMoney Insta Loan App is your go-to financial companion. Don't let financial emergencies hold you back, get the funds you need with DigiMoney Insta Loan App today.

Features of DigiMoney Finance: Loan App:

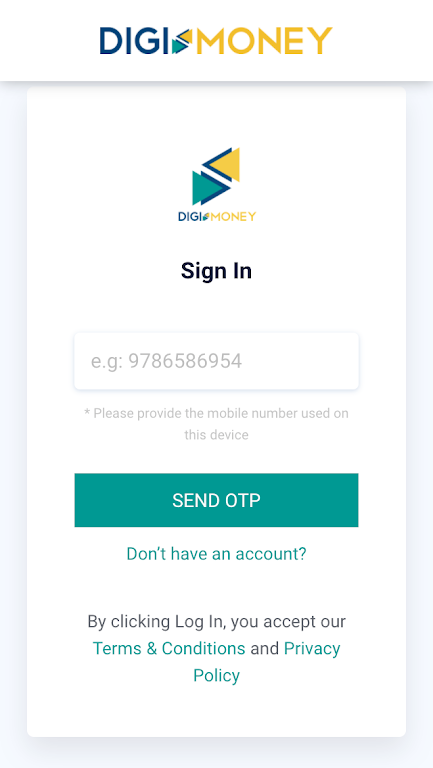

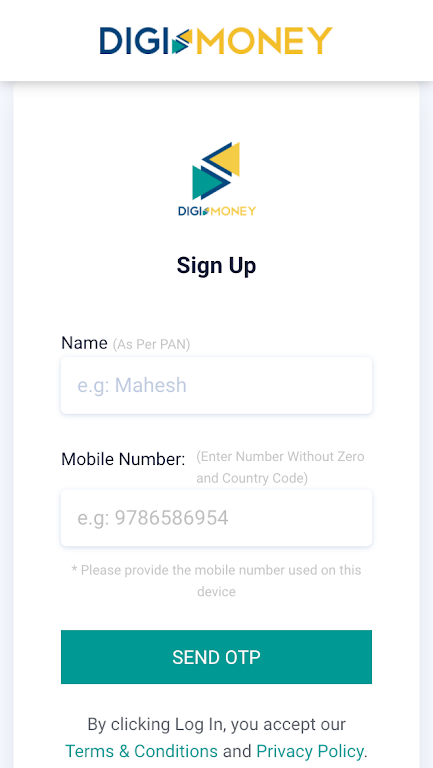

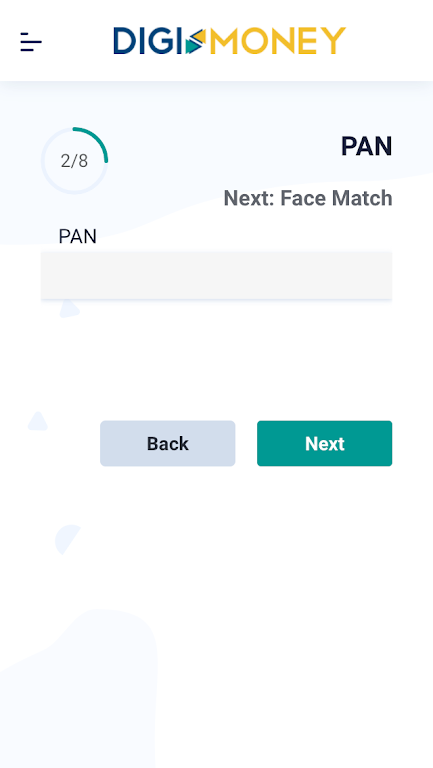

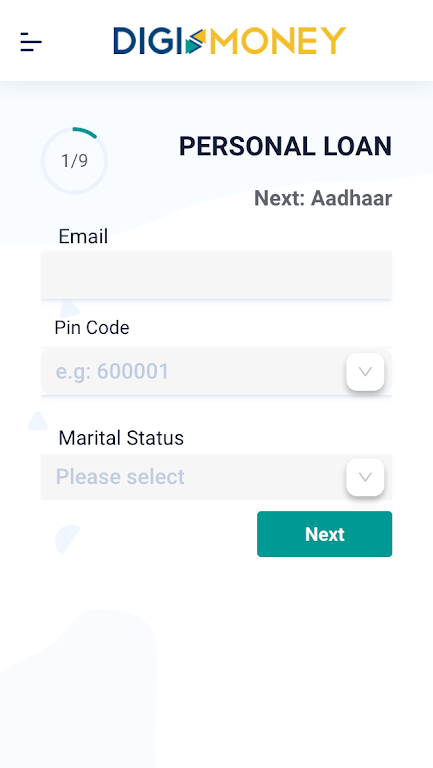

⭐ Digital and Automated Process: DigiMoney Insta Loan App offers a completely digital and automated lending process. Users can register, complete customer identification validation, undergo credit evaluation, sign the loan agreement, and set up e-mandates for loan collections/repayments, all through the app. This eliminates the need for manual paperwork and saves time for the users.

⭐ Instant Loan Disbursement: With DigiMoney Insta Loan App, customers can get their loan disbursed and have the money credited to their bank account in less than 10 minutes. This quick and hassle-free process is ideal for individuals in urgent need of funds.

⭐ Seamless Experience: The app provides a seamless lending experience to its users. They can navigate through the entire process easily and complete the necessary steps without any complications. The user-friendly interface ensures a smooth and efficient journey.

⭐ Affordable Interest Rates: DigiMoney Insta Loan App offers competitive interest rates on personal loans. Depending on the credit risk assessment, the APR or interest rates can range from 10% to 24% per annum. This allows borrowers to access funds at reasonable rates and manage their finances effectively.

FAQs:

⭐ How much loan can I get through DigiMoney Insta Loan App?

Currently, the loan amount you can avail depends on your eligibility and creditworthiness.

⭐ Is there a minimum loan period requirement?

Yes, the minimum repayment period for loans through the app is 3 months. The maximum repayment period is 12 months.

⭐ Are there any additional charges or fees?

Yes, there is a one-time processing fee starting from ₹1000 plus GST. This fee is deducted from the loan amount before disbursal.

Conclusion:

DigiMoney Finance: Loan App is a game-changer in the lending space, providing a digital and automated process for borrowers. With instant loan disbursal and a seamless experience, it offers convenience and efficiency to its users. The app also boasts affordable interest rates, making it a viable option for individuals seeking financial assistance. Whether you need funds for emergencies or personal expenses, DigiMoney Insta Loan App can be your go-to platform for quick and hassle-free loans. Download the app today and experience the future of lending.