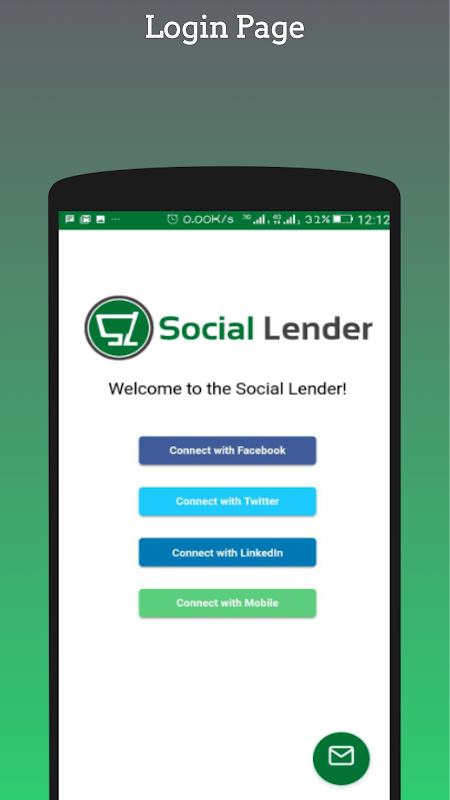

Social Lender is a groundbreaking app that aims to address the issue of limited access to formal credit in Africa. With over 50% of Adult Africans lacking access to credit, this innovative lending solution utilizes social reputation on mobile, online, and social media platforms to provide microcredit. By conducting a social audit of users' online profiles and networks, it assigns a Social Reputation Score to each individual, guaranteeing their loans from banks and other financial institutions. With quick access to cash within just 10 minutes, users can easily apply for funds through various channels such as web, SMS, USSD, mobile app, and even partner bank ATMs. With Social Lender, bridging the gap for immediate fund access has never been easier.

Features of Social Lender:

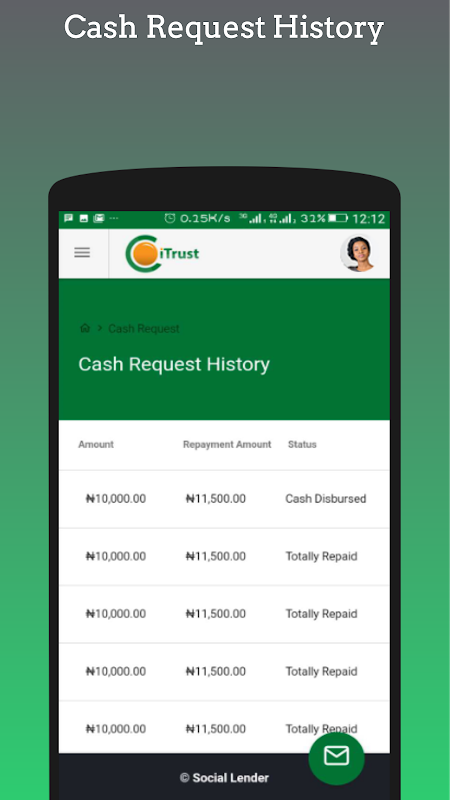

> Immediate Fund Access: The app offers a solution to bridge the gap for individuals with limited access to formal credit. With its proprietary algorithm, users can get quick access to cash within 10 minutes, providing immediate financial relief.

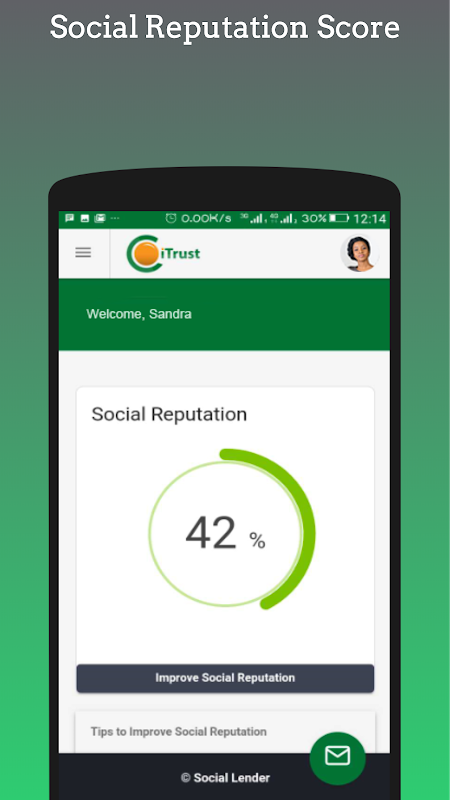

> Social Reputation-Based Loans: Unlike traditional lending institutions that rely on credit scores and collateral, Social Lender uses social reputation as a guarantee for loans. Users' online, mobile, and social media profiles are evaluated, allowing them to borrow from banks and other financial institutions based on their social reputation score.

> Various Access Channels: The app provides a range of channels for users to access their services. Whether it's through the web, SMS, USSD, mobile apps, partner bank ATMs, APIs, or even e-commerce checkout, users can conveniently apply for and receive cash from Social Lender.

> Financial Inclusion: With over 50% of adult Africans lacking access to formal credit, Social Lender plays a crucial role in promoting financial inclusion. By using social reputation instead of traditional credit metrics, individuals who would typically be excluded from credit opportunities can now access microcredit to meet their financial needs.

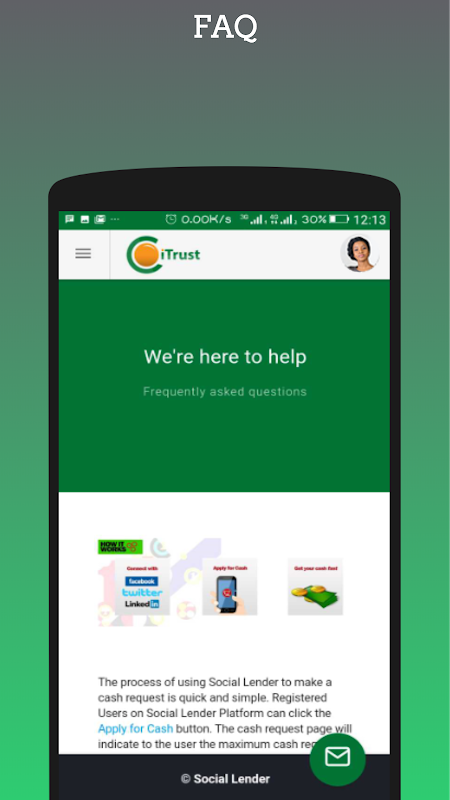

FAQs:

> How does Social Lender calculate the social reputation score?

The app uses its proprietary algorithm to analyze users' online, mobile, and social media profiles. Factors such as engagement, network size, content quality, and other relevant data are taken into account to calculate the social reputation score.

> What if I don't have a strong social media presence?

While a strong social media presence can positively impact your social reputation score, it is not the sole determining factor. The app considers various other platforms and factors to build a comprehensive profile of each user.

> Are the loans guaranteed by the user's social profile secure?

Yes, it ensures the security of users' data and privacy. The platform follows strict protocols to protect personal information and only uses it for the purpose of calculating the social reputation score and guaranteeing loans.

Conclusion:

Social Lender offers a unique lending solution that addresses the issue of limited access to formal credit in Africa. By leveraging social reputation, users can quickly obtain microcredit, meeting their immediate financial needs. With various access channels and a proprietary algorithm, it provides a user-friendly and secure platform for individuals to access much-needed funds. This innovative approach to lending promotes financial inclusion by providing opportunities to those traditionally excluded from credit. Experience the convenience and speed of this app today and unlock your access to financial freedom.